The importance of emerging markets to the global technology sector has been brought home by the current chip shortages affecting the manufacture of everything from smartphones to white goods and road vehicles.

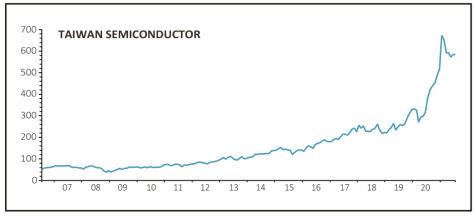

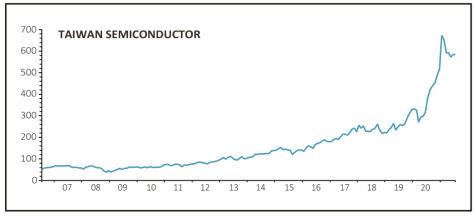

Semiconductor foundry Taiwan Semiconductor Manufacturing or TSMC for short is one of the most important players in this global supply chain and it is now the largest company in the MSCI Emerging Markets index – overtaking China’s e-commerce giants which have been affected by recent moves by the Chinese authorities.

TSMC is the world’s largest dedicated semiconductor foundry or fabrication plant – a highly complex facility which requires lots of expensive devices to function with the company upping its fabrication spend from $28 billion to $30 billion in 2021 and planning to invest $100 billion over the next three years.

Overall technology is comfortably the largest sector in the MSCI Emerging Markets Index, accounting for more than 20% of its value.

Technology is likely to play a key role in the recovery of the developing world from the pandemic with the International Monetary Fund noting in a recent publication that: ‘Some countries are seizing opportunities: in Asia, digitalization is transforming the efficiency of production, communication, and the inclusiveness of government operations.’

Technology is likely to play a key role in the recovery of the developing world from the pandemic with the International Monetary Fund noting in a recent publication that: ‘Some countries are seizing opportunities: in Asia, digitalization is transforming the efficiency of production, communication, and the inclusiveness of government operations.’

And a 2020 paper from the OECD noted that ‘technological developments are likely to bring many new opportunities, which may be even larger in emerging economies and may allow them to “leapfrog” certain stages of development’.

This outlook is part of a series being sponsored by Templeton Emerging Markets Investment Trust. For more information on the trust, visit here.

‹ Previous2021-07-29Next ›

magazine

magazine Technology is likely to play a key role in the recovery of the developing world from the pandemic with the International Monetary Fund noting in a recent publication that: ‘Some countries are seizing opportunities: in Asia, digitalization is transforming the efficiency of production, communication, and the inclusiveness of government operations.’

Technology is likely to play a key role in the recovery of the developing world from the pandemic with the International Monetary Fund noting in a recent publication that: ‘Some countries are seizing opportunities: in Asia, digitalization is transforming the efficiency of production, communication, and the inclusiveness of government operations.’