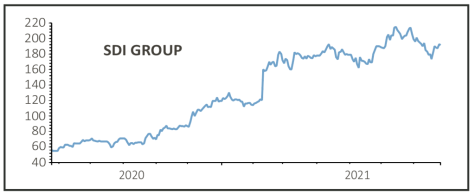

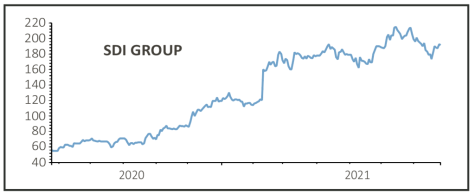

SDI (SDI:AIM) 194p

Gain to date: 11.2%

Original entry point: Buy at 174.5p, 27 May 2021

In the context of the global pandemic SDI’s (SDI:AIM) full year to 30 April 2021 results were impressive. In line with May’s trading update, revenue growth of 43.2% to £35.1 million (19% pre-acquisitions) and fully adjusted pre-tax profit soaring 70% to £7.4 million effectively beat market expectations in real terms.

Yes, there were some significant one-off Covid-19 related boosts which helped offset weakened demand elsewhere, but as the world gradually returns to normality analyst anticipate a return to steady and reliable progress.

As a reminder, SDI is a collection of multiple subsidiaries that design and manufacture digital imaging, sensing and control equipment used in life sciences, healthcare, astronomy, manufacturing, precision optics and art conservation applications.

Acquisitions are a major part of the story so it is pleasing to see growth opportunities enhanced by its latest, Monmouth Scientific. Strong cash generation (it cleared its £4 million net debt last year) and balance sheet strength underpin this acquisition strategy, with one analyst highlighting the benefit from the company’s increasingly diverse catalogue products and end markets.

‘With a good order book and good trading in May and June, as laboratories re-open post-pandemic, we leave revenues unchanged implying strong growth of 20%,’ FinnCap analysts said of their full year April 2022 forecasts.

SHARES SAYS: Still a great buy for the long-term.

‹ Previous2021-07-29Next ›

magazine

magazine