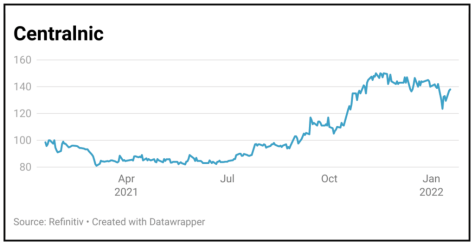

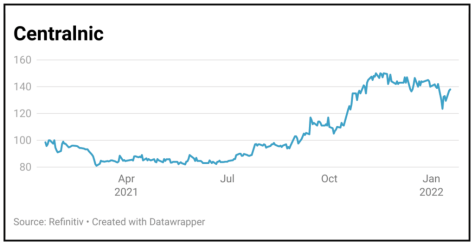

CentralNic (CNIC:AIM) 137.7p

Loss to date: 3.7%

Original entry point: Buy at 143p, 25 November 2021

This week’s trading update (17 January 2022) appears to have re-energised investors in CentralNic (CNIC:AIM) after the en masse sell-off in growth stocks since the New Year, with the share price rallying from the 123.5p it hit on 11 January.

No surprise there, the company reported roughly 60% year-on-year organic growth in the fourth quarter of 2021 and circa 37% organic growth for the entire year.

That’s enough to turn anyone’s head and analysts at investment Berenberg confirmed their fourth upgrade to 2021 numbers.

The significant acceleration in cash generation in the year has also allowed the business to de-leverage its acquisition spree debt quickly, going from around 2.8-times net debt to earnings before interest, tax, depreciation and amortisation at the end of 2020 to below 1.7-times at the end of last year.

To re-cap CentralNic provides the tools businesses need to thrive online, offering website registry services, distribution, strategic consultancy and marketing analytics for various types of internet domain names from a single platform.

SHARES SAYS: Remains a stock that growth investors should be buying.

‹ Previous2022-01-20Next ›

magazine

magazine