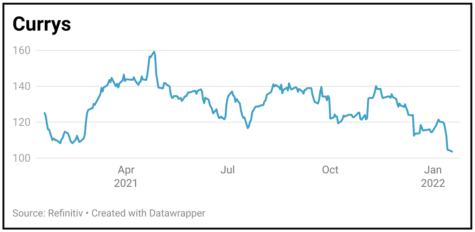

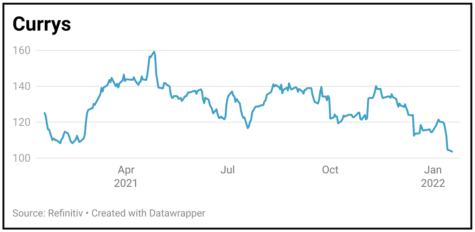

Currys (CURY) 103.3p

Gain to date: 19.9%

Original entry point: Buy at 129p, 15 July 2021

We’re calling time on our trade on electrical goods retailer Currys (CURY) after a string of disappointing news. The company is struggling and the market doesn’t seem convinced the business is going places.

The shares have recently taken a hit after the laptops-to-smartphones seller lowered full year pre-tax profit guidance from £160 million to £155 million following what it described as a ‘challenging Christmas with uneven customer demand and supply disruption’.

The downgrade wasn’t too much of a surprise, Currys had previously warned of weaker demand in the run-up to Christmas and that supply chain snarl-ups were impacting availability, though we are disappointed nevertheless that the retailer’s expected recovery has proved to be another false dawn.

The near-term risks to UK consumer spending are significant, even without any further Covid-related disruption.

Many people have spent significant sums on new laptops, smart TVs and smartphones during the pandemic. This kit can comfortably last them for many years without the need to upgrade, which suggests Currys could struggle to deliver meaningful growth in the months ahead.

SHARES SAYS: Exit Currys and seek out opportunities elsewhere.

‹ Previous2022-01-20Next ›

magazine

magazine