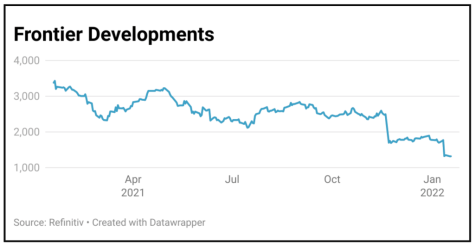

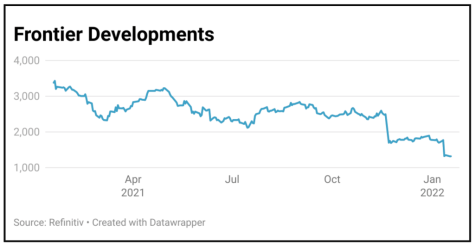

Frontier Developments (FDEV:AIM) £13.30

Loss to date: 41.3%

Original entry point: Buy at £22.65, 22 July 2021

Shares in fantasy world video game developer and publisher Frontier Developments (FDEV:AIM) are trading below pre-pandemic levels despite demand rising for games during the pandemic and the business developing a much larger pipeline of titles.

The latest share price fall followed a downgrade to 2022 and 2023 revenue guidance based on slippage of new game releases and disappointing initial sales of Jurassic World Evolution 2. Extra staff costs have contributed to reduced operating margins, now seen as being mid-single digit in 2022 before climbing back to around 20% in 2024.

We believe the problem hobbling the share price has been management’s overly ambitious guidance rather than fundamental development of the business. We hope lessons have been learned and guidance sufficiently rebased to achievable levels.

The outlook remains positive. The release of Jurassic World Evolution 2 has deepened its relationship with Universal Studios; it owns the exclusive rights to PC and console for the Formula One manager games, and exclusive PC, console and mobile rights to the Warhammer Age of Sigma strategy game.

SHARES SAYS: While we are disappointed by the performance of the shares, the potential of the business has not diminished. Still a buy.

‹ Previous2022-01-20Next ›

magazine

magazine