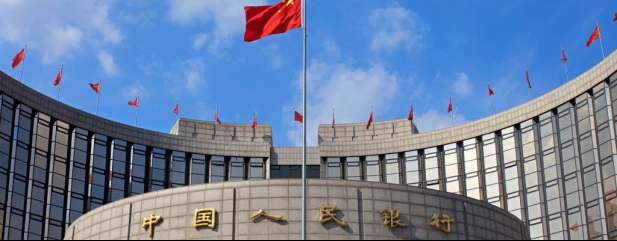

In an attempt to revitalise the economy, the People’s Bank of China has reduced the rate at which it provides one-year loans to banks by 10 basis points.

Critically this is the first time that China’s central bank has cut its interest rate in nearly two years, and contrasts with the approach taken by other major central banks around the world.

The US Federal Reserve has indicated that it plans to increase its interest rate three times this year. Closer to home, the Bank of England recently raised interest rates for the first time in three years, in response to mounting inflationary pressures.

Official data released on 17 January revealed that Chinese gross domestic product rose 4% last quarter from a year earlier. This marked the weakest level since early 2020 with concern over a property market slowdown and the impact of restrictions brought in to contain the spread of Omicron.

Despite this soggy macro-economic backdrop Chinese stocks including Alibaba, Baidu and JD.com are bouncing off their lows after a big slump in 2021, given less demanding valuations and an apparent easing of regulatory pressure after last year’s crackdown on the technology sector.

Alibaba is up 21% since rebounding from its low on 29 December, and Tencent is up 10% from its own nadir around the turn of the year.

‹ Previous2022-01-20Next ›

magazine

magazine