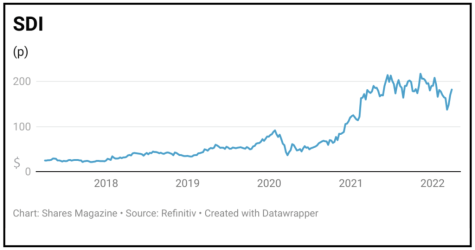

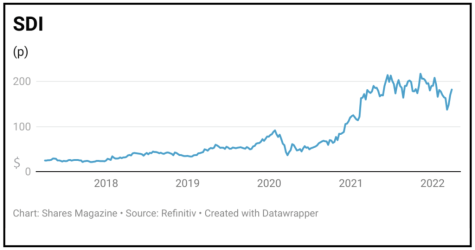

Gain to date: 1%

Original entry point: Buy at 174.5p, 27 May 2021

Science kit manufacturer SDI (SDI:AIM) may have retreated from the record share price highs reached in late 2021, but the company’s latest update suggests this is more a reflection of the wider shift from growth to value than any lack of progress for the business itself.

The company has announced the £7.7 million acquisition of SafeLab Systems. The deal, funded from SDI’s own cash resources and an existing debt facility, is expected by analysts to be immediately earnings enhancing. SDI is paying £5.5 million up front, of which £5.3 million is in cash and £200,000 in shares with a further £2.9 million payment to come shortly after completion.

Located in Weston-super-Mare, SafeLab makes high specification fume cupboards and similar cabinets for research laboratories and is focused on the education sector.

Progressive Equity Research’s Tessa Starmer says the acquisition, coupled with the recent purchase of SVS, more than fills the gap for sales and profits in the financial year to April 2023 against the exceptional levels achieved in the 2022 financial year, which were heavily boosted by more than £8 million of Covid-related revenues at SDI’s Atik division.

SHARES SAYS: A smart-looking deal, we remain fans of SDI’s long-term potential.

‹ Previous2022-03-31Next ›

magazine

magazine