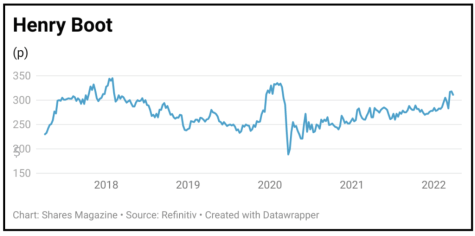

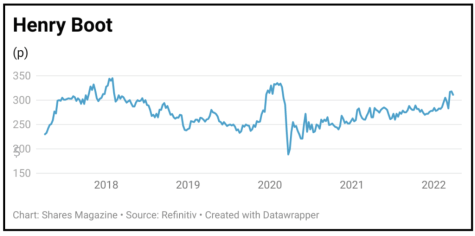

Henry Boot (BOOT) 312p

Gain to date: 11%

Original entry point: Buy at 281p, 30 September 2021

Construction and property firm Henry Boot (BOOT) posted a forecast-beating performance for the year to December and said it was enjoying a strong start to the current year with high levels of secured sales.

The group is focused on three key markets, industrial and logistics, residential and urban development, all of which are benefiting from structural tailwinds.

Although revenues only increased 3.7% last year, pre-tax profits were up 135% and return on capital employed recovered to 9.6% against 4.7% the previous year.

Net asset value per share increased 13.6%.

Such has been the strength of demand that the construction business has already secured over 100% of its 2022 budgeted order book, while the property development business has a £1.4 billion development pipeline.

Land promotion remained buoyant due to developers replenishing their land banks, allowing the firm to sell 50% more plots last year with an average 21% increase in selling prices.

It is committing more capital to the business to leverage returns and 2022 could be being a bumper year for valuations and earnings.

SHARES SAYS: We think the market is only just starting to appreciate the company’s merits.

‹ Previous2022-03-31Next ›

magazine

magazine