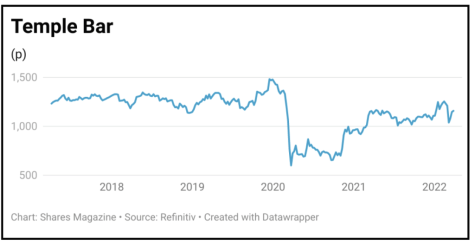

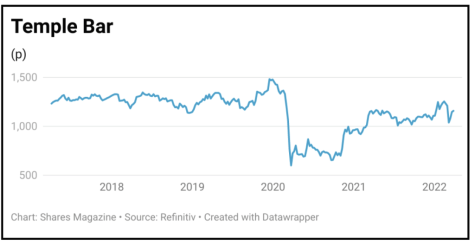

TEMPLE BAR INVESTMENT TRUST (TMPL) £11.64

Loss to date: 1.9%

Original entry point: Buy at £11.87, 13 January 2022

Recent choppy market conditions have left our ‘buy’ call on Temple Bar (TMPL) 1.9% in the red, but we still believe the UK equity income trust is well-positioned in an environment of runaway inflation and rising interest rates given its focus on value stocks.

A five-for-one share split in May, which will result in a more modest price per individual share, should boost liquidity and help those who invest on a regular basis or reinvest their dividends.

With the UK market still cheap versus overseas counterparts, Temple Bar is a great way to benefit from the rotation into decent, cash generative firms with robust balance sheets trading on lowly valuations.

Investors have been eager for exposure to the value-style stocks in the portfolio ranging from Royal Mail (RMG) and Marks & Spencer (MKS) to BP (BP.) and NatWest (NWG).

Results for 2021, which was Temple Bar’s first full year under the management of Redwheel duo Ian Lance and Nick Purves, showed a pleasing net asset value return of 24.5% versus the FTSE All-Share’s 18.3%.

SHARES SAYS: Keep buying.

‹ Previous2022-03-31Next ›

magazine

magazine