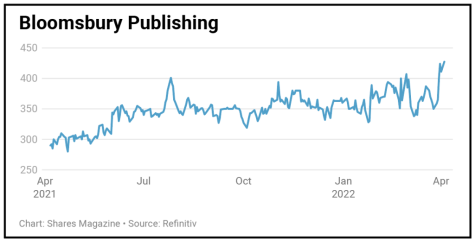

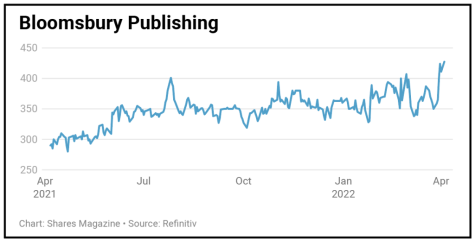

Bloomsbury Publishing (BMY) 403.2p

Gain to date: 42.5%

Original entry point: Buy at 283p, 4 February 2021

Our faith in Bloomsbury Publishing (BMY) continues to be rewarded with another encouraging trading update (30 Mar).

The company guided for revenue to be ‘comfortably ahead’ and profit ‘materially ahead’ of consensus expectations for the 12 months to 28 February.

A revival in reading seen during the pandemic looks to be continuing and Bloomsbury has demonstrated its ability to successfully mitigate ongoing supply and cost challenges.

Peel Hunt analyst Malcolm Morgan said: ‘Bloomsbury goes from strength to strength. It is a first-rate publisher, evidenced by the commercial and critical success it generates.

‘It is well financed – with significant cash assets on the balance sheet and investment in working capital, with the value of the library of publishing rights unrecognised on the balance sheet.

‘It is diverse in its subjects (children, adult, special interest, academic and professional), in the channels via which its product can be consumed (physical, e-books, online resources, rights), by the territory served (direct operations in the UK, US, India, Australia, and globally through export) and the nature of its routes to market (high street, online and direct).

SHARES SAYS: We continue to rate the shares as a ‘buy’.

‹ Previous2022-04-07Next ›

magazine

magazine