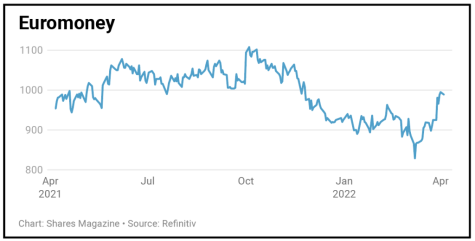

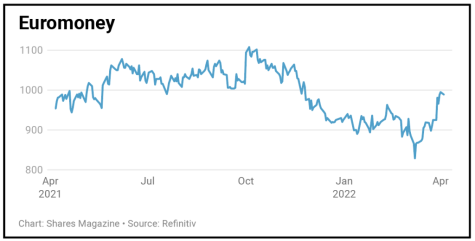

Euromoney Institutional Investor (ERM) 993p

Loss to date 11.4%

Original entry point: Buy at £11.12, 7 October 2021

Investors should stick with Euromoney (ERM) despite a soggy recent share price performance as its recovery is coming to fruition.

On March 31 the information services and events business revealed robust second quarter revenue growth.

This was primarily driven by continued demand in FastMarkets (commodity price benchmarks), and FPS Subscriptions (market and people intelligence).

The turnaround in the Asset Management division is also ahead of plan and there is a more encouraging outlook for the Events business.

There has been a consistent improvement in booking trends with various second quarter large events including Capacity Middle East, Metro Connect, IMN Build to Rent East, securing sales at levels above 2019.

Accompanying the trading update Euromoney management showcased their people intelligence business to analysts.

The division helps companies run their recruitment and HR functions more efficiently.

Numis media analyst Steve Liechti says: ‘We see a nice inflection point: Euromoney is now delivering post self-help as well as focus and investment in high quality subscription growth. Events also get much better from here.’

SHARES SAYS: We remain positive.

‹ Previous2022-04-07Next ›

magazine

magazine