Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

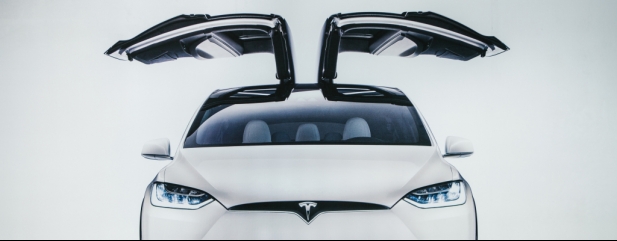

Tesla to split stock again following stunning recent share price rally

Nasdaq-listed Tesla (TSLA:NASDAQ) wants to split its shares for the second time in less than two years after the stock’s latest surge.

While the split details weren’t disclosed, when the stock last split in 2020, it handed investors five new shares for every existing one owned. More interestingly, that previous announcement also led to a rough 33% rally in the share price between the announcement (11 Aug 2020) and the stock split taking effect on 31 August 2020.

Tesla made its new stock split intentions clear at its annual shareholder meeting on 28 March 2022. Since then, the price has rallied from $1,010.64 to $1,145.45, a gain of 13%.

Shareholders will have to vote in favour of the split but investors backing seems highly likely. If we assume a similar five-for-one division, it would see shareholders handed five shares at $229 for every $1,145.45 one they now own.

Tesla stock struggled in the early part of this year as investors turned their back on growth in the face of rampant inflation, a rising tide of interest rate hikes and the geopolitical turmoil created by Russia’s invasion of Ukraine.

But the stock has staged a sharp rebound since the middle of March, following the company receiving German government backing to deliver the first cars built at its new factory outside of Berlin.

Shares are up a fraction shy of 50% since 14 March, a run that coincides with Tesla’s latest stock split announcement, giving the company a market value of $1.18 trillion.

Fanning the share price flames was news on 2 April that Tesla had delivered a record number of its cars in the first quarter, despite supply chain challenges. The electric carmaker said it delivered 310,048 cars from the start of this year to the end of March, up from 184,800 a year earlier, according to figures released over the weekend.

A number of other high flying tech stocks have announced splits recently, including Amazon (AMZN:NASDAQ) and Google-owner Alphabet (GOOG:NASDAQ). Both have announced plans for 20-for-one stock splits since the start of February.

Meme stock GameStop (GME:NYSE) also unveiled plans for a stock split on 31 March. GameStop’s share price jumped around 19% in after-hours trading yet investors seem more sceptical of its move, with the share price failing to hang on to those initial gains.

At $170.73, GameStop shares are just 2.5% up from where they closed before the announcement was made. The rationale for a split looks less clear than with the tech giants too as its shares already trade at a more bite-sized price.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Feature

- Invest with confidence - four funds which make a perfect portfolio

- European shares tend to do well when the US raises interest rates... not this time?

- Why Trainline still faces a big test despite ticket commission win

- Our 2022 stock portfolio rises against a volatile market backdrop

- ESG investing faces a watershed after Russia’s invasion of Ukraine

Great Ideas

- Euromoney set to benefit from strong growth as data-driven businesses excite

- Zoo Digital sets up shop in Scandi-thriller homeland after Bollywood move

- Invest in Rathbones as a wealth management bid frenzy highlights value appeal

- Soaring book sales help publisher Bloomsbury beat sales and profit expectations

- Casual dining group The Fulham Shore offers great scope for growth

- Belvoir continues to enjoy strong tailwinds in the UK property market

magazine

magazine