Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

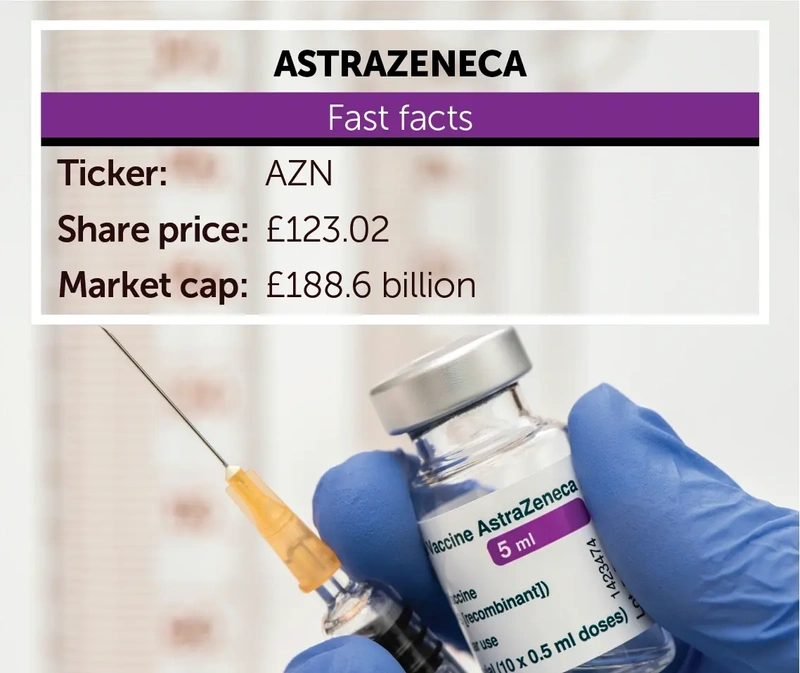

Discover how AstraZeneca has turned around its fortunes

It is 10 years since the board of AstraZeneca (AZN) rejected a cash and share takeover proposal from US rival Pfizer (PFE:NYSE) worth £53.50 per share on the grounds the price did not reflect the true value of the business.

Since rejecting the offer, AstraZeneca’s shares have appreciated three-fold while Pfizer’s shares are trading 5% below where they were trading a decade ago.

Credit must be given to the board of AstraZeneca and chief executive Pascal Soriot for steering shareholders in the right direction.

Soriot took over in 2012 and set about turning around the company’s fortunes. At the time, the group was facing an uncertain future due to many of its leading drugs going off-patent, opening them up to competition from low-cost generic drug makers.

REJUVENATING THE SCIENCE-BASED CULTURE

Soriot set about rejuvenating the science-based culture of the company in the belief scientific leadership would lead to long-term commercial success. The company redesigned its R&D (research and development) processes in order to increase productivity, and by 2016 nearly a fifth of its candidate drugs were making it through to late-stage clinical trials compared with only 4% in 2010.

A decade on, and AstraZeneca has achieved its goal of generating more than $45 billion of annual revenue by 2023, although a sceptic might argue the job was made easier by the $39 billion acquisition of rare disease specialist Alexion in late 2020 which brought in $5 billion of additional revenue.

Moving forward to today, at its investor day on 21 May, AstraZeneca announced a new ‘era of growth’ and an ambition to achieve revenue of at least $80 billion by 2030 and deliver a core operating margin in the mid-30s in percentage terms by 2026.

The new revenue target is around 25% higher than consensus analysts’ forecasts and the implied core profit target of $28 billion is 12% above estimates, suggesting upgrades are on the cards.

The company said it expects ‘significant’ growth from its existing portfolio of medicines and from the launch of 20 new medicines by the end of the decade, with several expected to achieve peak sales of more than $5 billion a year.

HOW DOES THE PHARMA INDUSTRY WORK?

AstraZeneca describes itself as a science-led business focused on the discovery, development and commercialisation of prescription medicines. The key to success is discovering effective medicines and bringing them to market before the patents which protect them expire.

A patent is a type of intellectual property which gives its owner an exclusive legal right for an invention and excludes others from making, using or selling it for a limited period in return for disclosing how the invention works.

This means every patent-protected medicine will go off patent at some point in the future and lose market share to cheaper-priced generic alternatives.

Patents usually run for 20 years, but it can take several years to subsequently prove efficacy and safety in order to get regulatory approval to launch a new product. That can often leave a relatively small window in which to reap the financial rewards.

Running a pharmaceutical business must feel a bit like trying to keep as many plates spinning as possible. Ideally a well-run pharmaceutical company is aiming to achieve a good balance between successfully-launched drugs and new ones in the pipeline, ready to replace declining sales from patent expiries.

AstraZeneca has one of the strongest drug pipelines amongst its peers as well as robust growth from its existing portfolio of medicines.

WHAT IS THE SHAPE OF THE BUSINESS TODAY?

Over the last decade the company has built strong franchises and scientific leadership in fast-growing therapeutic areas with its industry leading cancer treatments leading the way.

AstraZeneca’s key therapeutic areas by revenue are oncology (cancer), which generates 37% of group revenue, cardiovascular, renal and metabolic diseases (23%), rare diseases (17%), respiratory and immunology (13%), and vaccines and immune therapies which together generate around 10% of revenue.

The company has assembled one of the most diverse drug portfolios in the industry with 12 so-called blockbusters generating more than $1 billion each in annual sales.

In addition to four blockbusters in the oncology space, AstraZeneca has three in rare diseases and three cardiovascular treatments which rake in more than a billion dollars every year.

One notable feature is AstraZeneca’s relatively large exposure to emerging markets, which represent around 26% of group sales, second only to the US which generates 42% of group sales.

This means the company is well-exposed to the world’s two largest economies and one of the fastest growing regions. In 2023, emerging market revenue grew 20% making it the fastest-growing geography for the company.

HOW DO THE FINANCIALS STACK UP?

Pharmaceutical businesses have high gross margins which reflects the effective legal monopoly they enjoy on products sold under patent. Gross profit is the difference between sales and cost of sales.

In 2023, AstraZeneca generated sales of $45.8 billion and had a cost of sales of $8.1 billion leaving a gross profit of $37.7 billion, representing a margin on sales of 82%. This is above the industry-weighted average gross profit margin of 74% according to research group Hardman & Co.

SG&A (sales, general and administrative) expenses are deducted from gross profit to arrive at operating profit. The weighted average industry operating profit margin in 2021 was 32.5%.

AstraZeneca reported a core operating margin of 32% in the last financial year to 31 December 2023.

Looking at the bottom line, core EPS (earnings per share) has grown at a compound annual growth rate of 17% per year over the last three years. Strong profitability and double-digit growth are key drivers of shareholder returns.

Turning to the balance sheet, AstraZeneca ended 2023 with net debt to adjusted EBITDA (earnings before interest, tax, depreciation, and amortisation) of 1.6 times. This represents a modest level of financial gearing.

The company generated a return on equity of 29% in 2023 based on reported core EPS of $7.26 and shareholder equity of $25.50 per share.

On balance, therefore, AstraZeneca is a high-quality business generating a healthy profit and looks well-positioned to continue growing supported by a deep pipeline of new drug launches.

The one caveat we would mention is the company’s use in its accounting of core profit measures which exclude restructuring charges, exceptional legal costs and intangible asset amortisation.

RECENT TRADING AND OUTLOOK

The company grew its revenue by 19% to $12.7 billion for the three months to the end of March, around 7% higher than consensus forecasts, driven by 26% growth from the cancer franchise.

Core EPS was up 13% to $2.06 compared with market expectations of $1.92. The strong performance came after shareholders approved a controversial pay rise for long-serving chief executive Pascal Soriot.

AstraZeneca also hiked its annual dividend by 7% and reaffirmed 2024 guidance which calls for revenue and core EPS to grow by a low double-digit to low-teens percentage.

THE HISTORY OF ASTRAZENECA

The company’s origins date to the 1988 Anglo-Swedish merger between UK firm Zeneca and Astra AB, with the latter’s shareholders holding 46.5% of the combined group.

British multinational pharma company Zeneca was formed after ICI (Imperial Chemical Industries) demerged its pharmaceuticals and agrochemicals businesses in 1993. Shortly afterwards Zeneca acquired Salick Health Care, an operator of cancer centres in the US.

The transaction meant the company’s largest therapeutic area became cancer, and that remains its largest area of expertise 30 years later. In 1988 Zeneca decided to sell its agrochemicals division, preparing the ground for a merger with Stockholm-based Astra AB.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Feature

Great Ideas

News

- Watches of Switzerland shares fall on flagging demand for luxury goods

- AI chip champ Nvidia adds $230 billion in a day

- AstraZeneca shoots for the stars, GSK wins first Zantac trial and PureTech Health launches tender at a premium

- What will a general election mean for the markets and the economy?

- Seraphim chimes once again with investors

- Why Marks & Spencer can maintain its momentum

- Pressure mounts on cybersecurity hot stock Crowdstrike

magazine

magazine