Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Pocket money: how much to give and how to give it

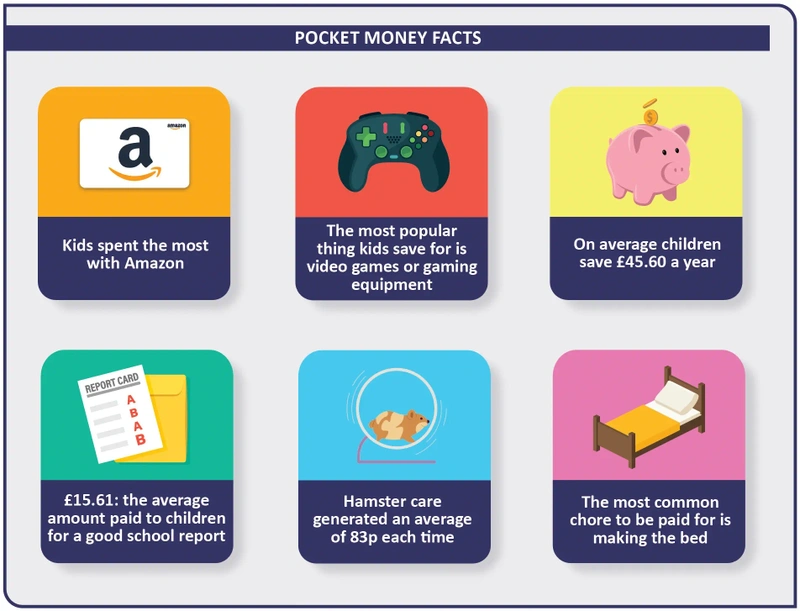

How much pocket money you should pay your children is a common dilemma among parents, but new data shows how much the nation is paying its kids.

The Natwest Rooster Money report shows how people using its pocket money app manage the payments and how much they pay their kids.

And children have felt the effects of the cost of living crisis, with their average pocket money reducing by £5.20 a year over the past year to £196.56. However, it’s not all doom and gloom, as the total amount handed over to kids rose from £478.40 a year to £479.96 in 2023/24 – up marginally over the past year. That includes pocket money and additional money given for chores, birthdays or extra treats.

Unsurprisingly, the amount parents give in pocket money rises as children get older, from £2.75 a week for a six-year-old up to £8.42 a week for 17-year-olds – with extra payments topping that up to £5.68 a week for six-year-olds up to £24.71 a week for 17-year-olds. But with so much money being digital now, what’s the best way to sort out pocket money for your kids?

CASH AND A PIGGY BANK

This option has the benefit of giving children an idea of tangible money – they can count out their coins and it might help them to link the value of money to a physical object. Also, for younger kids it’s undeniably fun to put money in a moneybox.

The downside? Lots of what they want to spend on is digital now – from ordering things on Amazon to digital credits for gaming. You’ll end up using your card to pay for these things and taking the cash back. Also, you’ll need to have cash each week to hand over their pocket money – which could be a hassle for parents who rarely have cash.

DIGITAL APPS

There are several digital apps and physical bank cards you can use now to help manage your child’s pocket money online. GoHenry was one of the first, but there is Natwest Rooster Money, Osper and Nimbl, and Revolut has an under 18s offering too if parents are a customer.

These all work in a similar way, in that the child has a bank account that parents can transfer money to, and the child has a physical card that they can use to spend money in-store or online. It’s easier for parents to manage the money, as they can just transfer pocket money from their account to the child’s. And most will allow parents to see where their child is spending money. Equally the child can spend money both online and in shops, which should cover most of their spending needs. The other good feature of the apps is that quite a few offer financial help, money tips and the option to save money into different buckets. This can help to teach children good money habits. Although parents could do a similar thing with cash if they wanted to.

The downside is that these apps cost money. It varies but for example the basic account with GoHenry costs £3.99 a month per child – which if you have multiple children can really add up. Natwest’s offering is cheaper at £19.99 for the year. Some of them charge for you transferring money to the card, while others offer a certain number a month for free, while others charge for ATM withdrawals. It’s a good idea to think about how your child will use the account before you pick one. The other downside is that the apps are only for children six and older, so if you have young kids you’ll have to stick to old-fashioned cash.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Feature

Great Ideas

News

- Watches of Switzerland shares fall on flagging demand for luxury goods

- AI chip champ Nvidia adds $230 billion in a day

- AstraZeneca shoots for the stars, GSK wins first Zantac trial and PureTech Health launches tender at a premium

- What will a general election mean for the markets and the economy?

- Seraphim chimes once again with investors

- Why Marks & Spencer can maintain its momentum

- Pressure mounts on cybersecurity hot stock Crowdstrike

magazine

magazine