Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Will mid-cap stocks come back to the fore once more?

A feature of the recent recovery in stock markets has been the leadership role played by large-caps. This represents a reversal of a longer-term trend, particularly in the UK, of medium-sized businesses setting the pace.

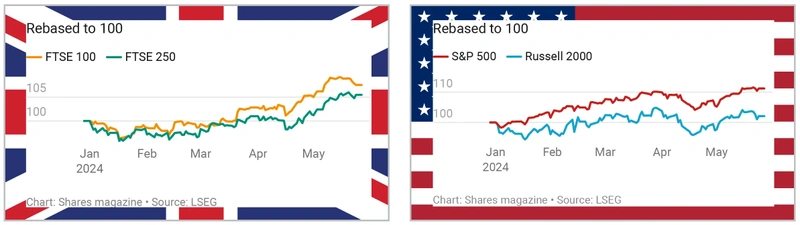

As the charts show, year-to-date the FTSE 250 has lagged behind the FTSE 100 while in the US the Russell 2000 (made up of the 2000 smallest companies in the broad-based Russell 3000 index of US stocks) has come a distant second-best compared with the large-cap S&P 500 benchmark.

Berenberg analyst Jonathan Stubbs notes: ‘Support for (UK) mid-caps remains in place, with plenty of companies trading at attractive valuation levels with high levels of cash generation and strong balance sheets.’

Beyond these short-term attractions, which are already proving a driver for M&A activity, there are several fundamental reasons why mid-caps might be of interest to investors:

- Growth potential: First, because they are smaller, mid-cap firms typically have more significant growth potential and can increase their profit at a rapid rate if things are going well.

- Choice: The FTSE 250 is more diverse than the FTSE 100 with areas such as engineering and technology more widely represented.

- Potential for earnings upgrades: Companies in the FTSE 250 are not as widely followed as those in the FTSE 100 so analysts are more likely to underestimate (or overestimate) earnings. This can be both good and bad: earnings upgrades can lead to increases in the share price although the reverse is true if a company falls short of earnings forecasts.

Although mid-cap stocks can be more volatile than larger companies they are unlikely to see the wild share-price swings which can occur in small- and micro-cap companies. They are also much more likely to pay a dividend and can therefore offer a winning combination of growth and income.

Nick Train has been busily apologising again for the underperformance of his popular Finsbury Growth & Income Trust (FGT). Train has blamed this on a lack of exposure to the technology and energy sectors which seems a logical diagnosis.

However, the cure is less obvious. While Train points to additions to the portfolio since 2020 like Rightmove (RMV) and Experian (EXPN), these are not technology stocks as such – even if they apply technology in their respective property market listings and credit data business areas.

It would seem a mistake at this point to suddenly start buying lots of technology businesses, which he has previously acknowledged he does not understand, leaving him with little option but to sit tight and hope performance picks up.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Feature

Great Ideas

News

- Watches of Switzerland shares fall on flagging demand for luxury goods

- AI chip champ Nvidia adds $230 billion in a day

- AstraZeneca shoots for the stars, GSK wins first Zantac trial and PureTech Health launches tender at a premium

- What will a general election mean for the markets and the economy?

- Seraphim chimes once again with investors

- Why Marks & Spencer can maintain its momentum

- Pressure mounts on cybersecurity hot stock Crowdstrike

magazine

magazine