Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Investors have four options with the blockbuster National Grid rights issue

On 23 May, power network operator National Grid (NG.) announced a bumper £7 billion fundraise to help finance a five-year £60 billion investment plan.

Known as a ‘rights issue’, the exercise involves shareholders making a decision whether or not to buy discounted shares in the group.

As is the case for most major rights issues, National Grid’s fundraise is fully underwritten by banks, in this case Barclays (BARC) and JPMorgan (JPM:NYSE), who will step in and buy any rights not taken up by existing shareholders.

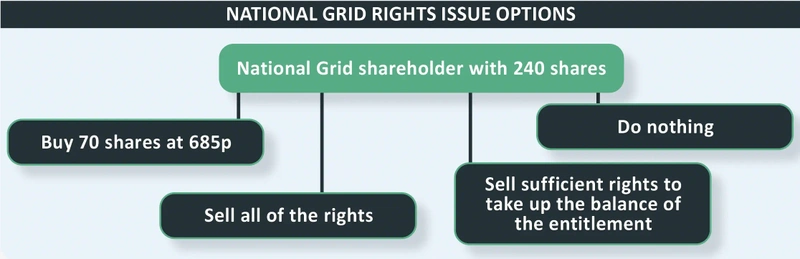

Shareholders must take one of four routes:

- Buy some or all their allocated stock

- Sell all their rights

- Sell some of their rights and use the proceeds to buy some of the cut-price shares (known as ‘tail swallowing’)

- Do nothing

WHY DO COMPANIES UNDERTAKE RIGHTS ISSUES?

Rights issues can be an effective way for companies to raise new money for large acquisitions, big capital investments or to strengthen their balance sheet.

This method of raising capital was heavily-used by companies in the wake of the financial crisis - banking group Lloyds (LLOY) undertook a £13.5 billion issue in 2009, for example. More recently, EasyJet (EZJ) was one of several firms to use a rights issue to rebuild its balance sheet coming out of the pandemic. National Grid’s rights issue is the largest since Lloyds went cap in hand to the market 15 years ago.

Investors do not always welcome rights issues as their discounted price tends to pull down the market price of a stock, so shareholders typically take a hit to the value of their investment.

Many companies would argue that is the price investors pay to allow their business to grow, and the longer-term benefits will more than compensate them for the short-term hit to the value of their shares.

WHAT HAPPENS NEXT IF YOU’RE INVESTED IN A FIRM HOLDING A RIGHTS ISSUE?

You need to ascertain why the company you’re invested in is asking for more money. Does the desired cash only provide a quick fix to a financial problem and not a permanent solution?

In the case of National Grid, the focus is on investing for the future rather than fixing a broken balance sheet. The company plans to double the level of its investment of the previous five years, allocating £60 billion between 2024 and 2029.

This encompasses £23 billion on energy transmission in the UK to help expand offshore wind development as well as £8 billion on ‘asset replacement, reinforcement and new connections’, with the balance to be spent in the US.

FOUR OPTIONS FOR NATIONAL GRID INVESTORS WITH THE COMPANY’S RIGHTS ISSUE

1. TAKE UP YOUR RIGHTS

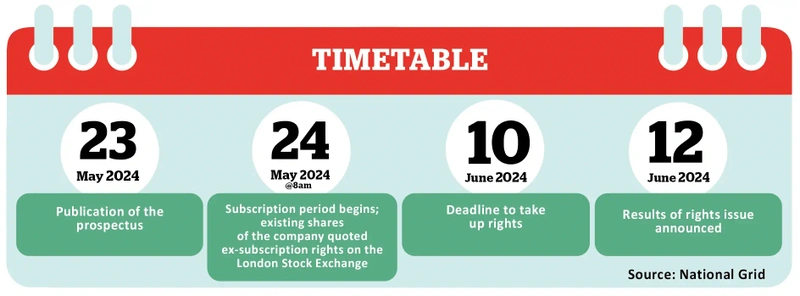

Shareholders are typically offered the right to buy a set number of shares in proportion to the number they already hold. National Grid is offering seven new shares at 645p each for every 24 existing National Grid shares held as of 8am on the 24 May. The official deadline to subscribe for the new shares is 11am on 10 June, but for most investment platforms the actual deadline may be earlier.

To illustrate, if you own 240 National Grid shares you have the chance to buy 70 new shares costing £451.50 in total. You would then have 310 shares and own the same percentage of the company as you did before the rights issue.

2. SELL ALL YOUR RIGHTS

The rights associated with shares in a rights issue have an intrinsic value and can be traded separately in the market. These are known as nil-paid shares or nil-paid rights.

Shareholders can sell their rights to someone else and receive some money, all without having to sell their existing shares.

To calculate the price at which the shares could trade after a rights issue, analysts seek to calculate something called the TERP or theoretical ex-rights price. This is based on a combination of the value of the existing shares at the share price before the rights issue was announced and the new shares at the subscription price.

In reality the actual share price will also be affected by what motivated the rights issue and the company’s particular circumstances at that time.

The TERP (adjusted for the 2024 dividend of 39.12p) is 988p so the 645p issue price represents a 34.7% discount.

What if you want to sell your rights? An indicative value would be the difference between the theoretical ex-rights price and the subscription price which is 343p per share in the case of National Grid (988p minus 645p).

Therefore, someone holding 240 shares could in theory net £240.10 in cash by selling their rights (343p x 70 new shares). However, in reality the rights would sell for what other investors are willing to pay for them.

3. SELLING SOME RIGHTS TO PAY FOR THE COST OF SOME NEW SHARES

An alternative is to sell some of the nil-paid rights to cover the cost of buying some of the new shares in the rights issue.

Here, you would sell enough rights to take up the balance of your entitlement under the rights issue, using the net proceeds of the sale, and you wouldn’t need to invest any new money to take up the balance of your rights.

4. DO NOT TAKE UP THE RIGHTS

You could allow your rights to lapse. If the National Grid share price is trading below the offer price of 645p on the subscription deadline, the nil-paid rights would expire worthless.

But if they are trading above 645p you could receive a cash payment per nil-paid share equivalent to the National Grid share price less the offer price.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Daniel Coatsworth

Editor's View

Feature

Great Ideas

News

- Bloomsbury’s purchase of US academic publisher signals acceleration of strategy

- Ferrexpo shares slump on war, government spats and legal issues

- Indian stocks retreat from record high on third term for prime minister Modi

- Why Shein’s £50 billion IPO will give ASOS and Boohoo the shivers

- Latest index shake-up sees Darktrace bump Ocado out of the FTSE 100

magazine

magazine