Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

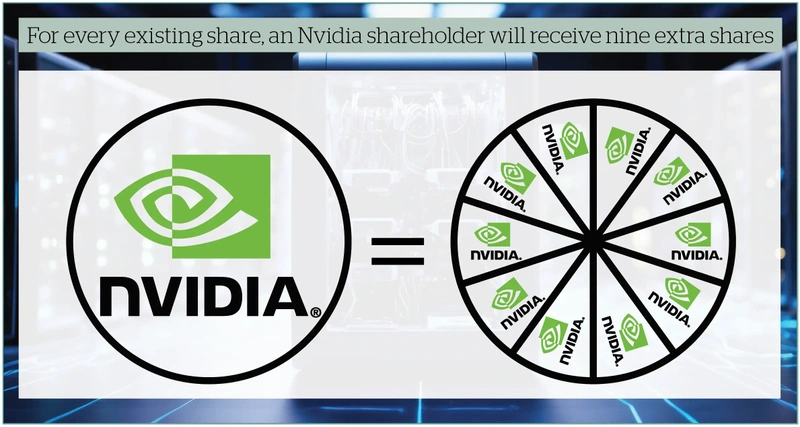

Nvidia is taking steps to make its stock more affordable

Would you invest in a company if it costs more than $1,000 per share? The price tag might put people off, either because they could not afford it or they consider that amount to be too expensive. Finding a solution is exactly the discussion in Nvidia’s (NVDA:NASDAQ) boardroom in recent months. The world’s most talked-about stock has decided the answer lies in a stock split.

On 7 June, Nvidia shareholders will receive nine extra shares for each share they already own. They will not have to pay for them and this process will create a technical adjustment to the share price – i.e., bring it down. For example, if someone had 10 shares trading at $1,000 apiece at the point of the adjustment, that investment would become 100 shares valued at $100 each.

The total value of the investment would be unchanged, but the investor would own more units and the share price would be a fraction of what it was.

ALL IN THE MIND

Share price matters from psychological point of view. There is a reason a certain type of investor likes penny shares – they buy a bucket load for £50 versus potentially a single share for a FTSE 100 company for the same amount.

It is like going to a corner shop and buying 80 Freddo chocolate bars for £20 or paying the same for a large box of Thorntons which might only have 20 chocolates inside – you feel like you’re getting a better deal with the Freddo bar given the quantity, but the Thorntons box with fewer items might be a lot better quality.

What certain individuals often miss is that one judges investment success by the returns they provide investors. You cannot work out if a stock is excellent value or not by simply looking at its share price. You need to compare that figure to metrics such as the ratio of earnings or sales.

Someone could have 200 shares in a penny stock worth £1,000 and 20 shares in a FTSE 100 stock also worth £1,000. You cannot say with certainty that the penny stock is better value than the FTSE 100 company. If they both go up by 10% in value, the returns are the same even though the investor would own more shares in one than the other.

WHAT HAPPENS NEXT?

Nvidia’s shares are about to become more affordable on a per share basis which is good for investors who only have a limited amount to invest or for the chipmaker’s employees buying shares each month in a share scheme. For example, at $1,000 a share, certain people would not have been able to afford a single unit. But they might be able to afford one at $100 per share.

Certain investors might see the sudden drop in price and think they are now getting a bargain, even though the actual value of the whole business is unaffected at that point by the share split. Will that trigger a big wave of new buyers? In theory, it might.

Analysis by BoA Research in 2022 found that companies generated approximately 25% average return in the 12 months after announcing a stock split, based on data since 1980. The S&P 500 returned 9.1% over the same period.

Share splits tend to happen when a company is doing well and their share price rising. Undertaking this adjustment to their price is effectively waving a flag and saying, ‘Look at us! We have been doing so well that our share price can’t stop rising.ʼ It sends a signal to investors who follow a momentum strategy that stock should be on their radar.

It can work both ways. Shareholders might suddenly discover they have more shares in their account for free and that might that encourage them to sell part of their holding. Enough people acting this way could move the share price down.

SHARE SPLITS VERSUS SHARE CONSOLIDATIONS

While share splits are a signal of a company doing well, share consolidations can be the opposite. This is when a company reduces the number of shares in issue as that automatically increases the price. Like a bike with a puncture, you can only pump it up temporarily but unless you change the inner tube – i.e., for companies with a share consolidation, change something with the business – it could easily deflate again, and that also applies to the share price.

When an investor buys a fund, it is fair to say most people do not pay attention to the price. You typically specify how much you want to invest, not how the number of units you want to buy. That is because you can buy fractions of a fund so affordability does not come into the equation. If you have £100 to invest, you can buy 0.002 units of a fund for example.

In the US, fractional shares are growing in popularity. The UK is playing catch-up, but progress is slow because you have not been able to hold fractional shares in an ISA. The government has outlined changes to the ISA rules which would permit certain fractional shares but this has not come into force yet.

That means share splits will continue to be the principal way for companies to address the affordability issue for those looking to invest lesser amounts. There are stocks who might consider this route, given that 107 companies in the S&P 500 trade on a share price in excess of $250, as of 24 May 2024. It is less of a problem in the UK where only two FTSE 100 stocks trade above £100 and only 11 stocks above £50 per share.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Daniel Coatsworth

Editor's View

Feature

Great Ideas

News

- Bloomsbury’s purchase of US academic publisher signals acceleration of strategy

- Ferrexpo shares slump on war, government spats and legal issues

- Indian stocks retreat from record high on third term for prime minister Modi

- Why Shein’s £50 billion IPO will give ASOS and Boohoo the shivers

- Latest index shake-up sees Darktrace bump Ocado out of the FTSE 100

magazine

magazine