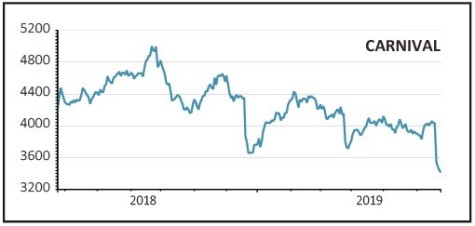

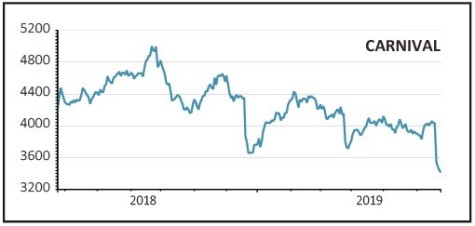

Carnival (CCL) £34.24

Loss to date: 12.7%

We reiterate our buy stance on Carnival (CCL), following a fall in the shares in reaction to the company lowering its full year guidance for earnings per share by 3% to 5% to between $4.25 and $4.35.

The bulk of the downgrade was down to propulsion issues at Carnival Vista, and a change to the US government’s policy towards Cuba, both one-off issues which reduced revenue yields.

There was also a small impact from capacity increases in Germany and economic deterioration in France, although these were partly offset by lower fuel consumption and favourable foreign exchange movements. It should be noted that the second quarter results were ahead of prior guidance.

A change to annual earnings guidance of this magnitude does not hugely impact longer term earnings potential. For some perspective, it is always useful to keep in mind that equities are long duration assets, discounting 20 to 30 years of future earnings.

Analyst Greg Johnson of Shore Capital points out that Carnival’s enterprise value-to-berth is currently less than $170,000. He says: ‘A value of under $170,000 per berth has only previously been seen during periods of extreme stress, notably during the Gulf War, the Financial Crisis and the sinking of the Concordia.’

SHARES SAYS: Disappointing but certainly no reason to abandon the trade. Stay positive.

‹ Previous2019-06-27Next ›

magazine

magazine