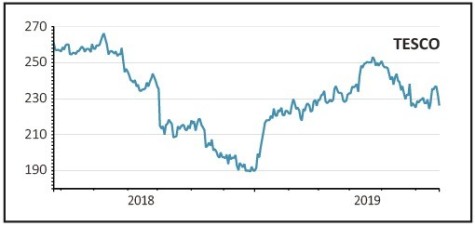

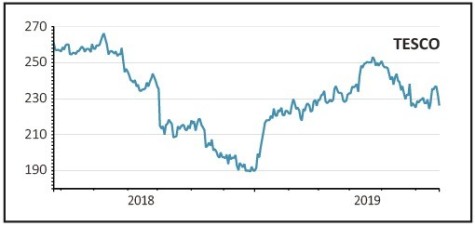

TESCO (TSCO) 226p

Loss to date: 4.6%

Tesco (TSCO) shares have lagged the FTSE 100 since May but we are sticking with our call after the first quarter trading update (13 Jun) and the recent capital markets day (18 Jun).

Despite a tough comparison with last summer, Tesco still managed to increase turnover by more than the market in the first quarter with a particularly strong performance in fresh food. Also the Booker acquisition is delivering growth as planned.

The comparison with 2018 will remain hard in the second quarter given that grocery sales are backward-looking and last summer’s boost was still being felt in the numbers until October.

However, Tesco is focused on keeping hold of its customers, raising its revenue and trimming costs so that its margins and cash generation improve.

As well as working with its suppliers, it has a global sourcing alliance for household products with France’s Carrefour which reduces costs considerably.

Other ways to improve profits include smaller local stores, the Jack’s own-brand range and own stores, increasing use of technology including cashless payment and less expensive but more effective marketing.

SHARES SAYS: Grocery sales are growing steadily and Tesco is the undisputed market leader. Investors are worried about tough comparisons with last year but the company is already planning for next year. Buy.

‹ Previous2019-06-27Next ›

magazine

magazine