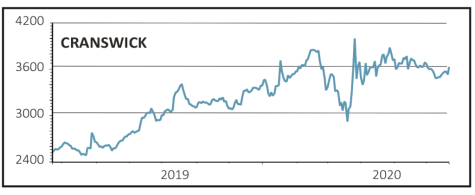

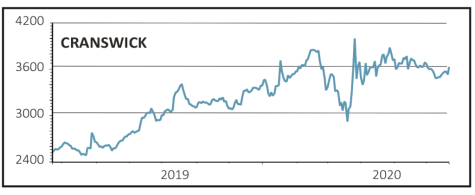

CRANSWICK (CWK) £37.68

Gain to date: 3.8%

Original entry point: Buy at £36.30 on 2 April 2020

We remain positive on quality food producer Cranswick (CWK) following better than expected full-year results on 23 June.

It is benefiting from two major tailwinds; lockdown is driving bumper demand for food consumed at home while African swine fever has destroyed pig herds in China and has presented a major export opportunity for the company.

For the year to 28 March, total sales rose 16% to £1.7 billion, leading to better than expected pre-tax profits of £102.3 million, up 11.2% and aided by the robust UK demand we’d anticipated. Total export revenue rose 92%, with Far East exports up 122%, as African swine fever outbreak boosted volumes and prices.

With a strong balance sheet and healthy liquidity, Cranswick also increased the final dividend by 9.8% to 43.7p for a total dividend of 60.4p, reflecting 30 years of unbroken dividend growth.

‘Whilst management talk of a “positive” start to the new year, with we believe strong growth coming from UK retail channels, enough uncertainty coming from Covid-19, China pork prices and Brexit remain for us to leave our prudently pitched full year 2021 forecasts unchanged for now,’ cautions Shore Capital.

SHARES SAYS: Cranswick is benefiting from two significant tailwinds and given its strong balance sheet and enviable long-run dividend growth record, we

remain buyers.

‹ Previous2020-06-25Next ›

magazine

magazine