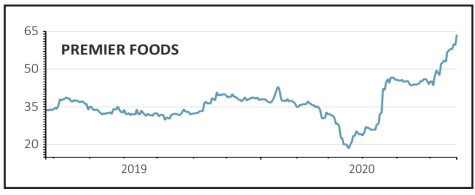

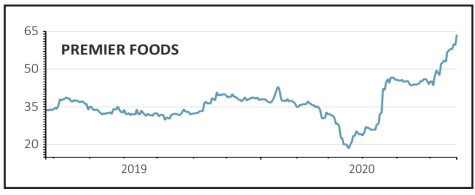

PREMIER FOODS (PFD) 63.55p

Gain to date: 53.3%

Original entry point: Buy at 41.45p, 23 April 2020

Our bullish call on Mr Kipling cakes-to-Bisto gravy maker Premier Foods (PFD) is already 53.3% in the money, yet there should be more upside to come given tasty trading momentum.

Our positive stance was based on a recent transformational pensions deal, which has de-risked the business, as well as strong trading driven by marketing and innovation spend with a recent boost from people eating more sweet treats during lockdown.

Results for the year to 28 March revealed trading profit at the top end of market expectations as well as a £62m net debt reduction, lowering Premier Foods’ leverage ratio to 2.7-times, beating its previous 3-times target.

The company has seen particularly high levels of demand for items relating to meal preparation, including cooking sauces, gravy and baking ingredients.

Following sales growth of 7.3% in the fourth quarter of its financial year, the UK business has now delivered 11 consecutive quarters of revenue growth.

Analysts upgraded their forecasts on news that sales in the first quarter of the new financial year are expected to be roughly 20% ahead year-on-year amid ‘continued strong demand’ for Premier Foods’ ranges.

Despite incurring some extra supply chain costs, the food producer expects to beat this year’s revenue and trading profit estimates.

SHARES SAYS: The business is looking in much better shape and the pension pressures have eased. Keep buying.

‹ Previous2020-06-25Next ›

magazine

magazine