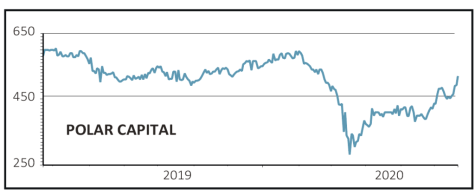

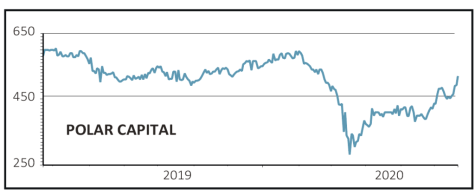

Polar Capital (POLR:AIM) 502p

Gain to Date: 10.3%

Original entry point: Buy at 455p on 18 June 2020

Full-year results from the asset manager highlighted good strategic progress while post year-end the business has experienced positive net inflows.

For the year to 31 March, net management fees increased 5% to £119.5 million, in line with growth in the group’s average assets under management (AUM) to £14.1 billion.

However, core operating profit excluding performance fee profit fell slightly to £41.6 million (2019: £42.2 million). This was caused by an increase in staff costs in relation to new team hires and additional distribution capabilities in the US and Nordic markets. In addition, the firm recruited its first chief investment officer and established a central dealing desk.

Over 70% of the company’s funds are ahead of their benchmark for the calendar year to 29 May. Institutional investors tend to focus on longer-term performance and several of the group’s products have achieved a top decile ranking since inception, including the £5.3 billion Polar Global Technology Fund (B42NVC3). Technology-related investments now represent 43% of the group’s AUM.

The company maintains a conservatively managed balance sheet with £108 million of cash at 31 March. This financial strength allowed the company to propose paying a second interim dividend of 25p per share, taking the full-year dividend to 33p per share, equating to an attractive 6.6% yield.

SHARES SAYS: Polar Capital remains a high-quality business. Keep buying the shares.

‹ Previous2020-06-25Next ›

magazine

magazine