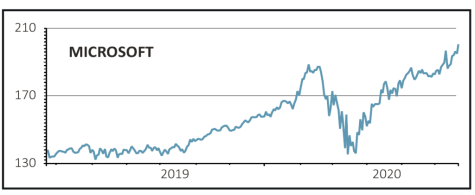

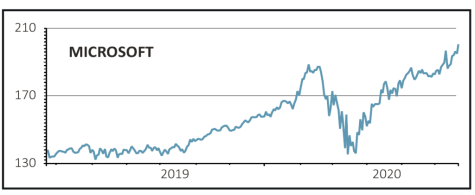

Microsoft (MSFT:NDQ) $200

Gain to date: 17.5%

Original entry point: Buy at $165 on 9 April 2020

Big tech stocks have been among the winners for investors this year, particularly in the US where they’ve helped push stock markets back up to pre-coronavirus levels.

One of those winners has been Microsoft, which has gained 17.5% since we said to buy just two months ago and is now trading at a new all-time high of $200 a share.

Investors can’t seem to get enough of the stock with its momentum fuelled by its ability to continue trading well throughout the current pandemic.

The company shrugged off any impact from coronavirus in its third quarter results to 31 March, published in late April, with sales up 15% as chief executive Satya Nadella said the company had seen two years’ worth of digital transformation in two months.

Particularly noteworthy was the jump in revenues in its commercial cloud operations, its fastest growing division and one of the areas seen as having the most promise given its importance to digital transformation, which soared 39% year-on-year to $13.3 billion.

The company also returned $9.9 billion to shareholders in the form of share repurchases and dividends in the third quarter, an increase of 33% compared to the third quarter of its 2019 financial year.

SHARES SAYS: Microsoft looks well-placed to continue thriving in the current environment. Keep buying.

‹ Previous2020-06-25Next ›

magazine

magazine