With prime minister Boris Johnson sticking to his roadmap and jabs being injected into the arms of a grateful global population, the grand economic reopening that beverage businesses have been clamouring for since the pandemic clobbered the sector is upon us.

As out-of-home sales channels such as hotels, restaurants, pubs, bars, cinemas and entertainment venues including sporting stadia spring back into life, soft drinks makers should profit as thirsty populations emerge from lockdown around across the globe and hot weather stirs sales recovery.

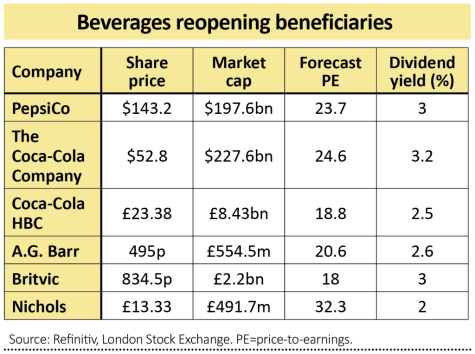

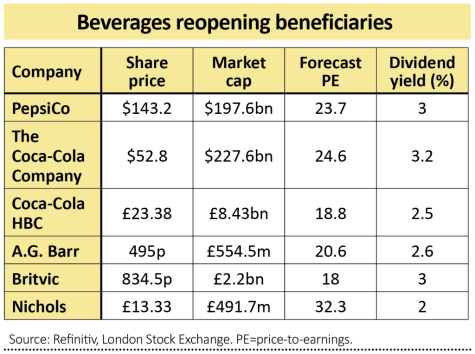

Across the pond, shares in PepsiCo have perked up from $128.8 in early March to $143.2 at the time of writing as the market discounts the benefits of the reopening on the organic growth prospects of the snacks and drinks behemoth.

While the social hibernation caused by the pandemic boosted sales of PepsiCo’s snacks including Doritos and Cheetos, a summer of sun, sport and socialising could drive strong sales of brands including Walkers crisps and Pepsi-Cola, not to mention Gatorade, Mountain Dew and Tropicana.

PepsiCo’s arch-rival The Coca-Cola Company has an even greater exposure to out of home channels and the James Quincey-steered drinks colossus has several brands positioned to benefit including Coca-Cola, Diet Coke, Sprite and Fanta as well as coffee brand Costa and mixers brand Schweppes.

UK stocks connected to Coca-Cola include strategic bottling partners Coca-Cola HBC (CCH) and Coca-Cola European Partners (CCEP).

Lower down the market cap spectrum, resilient soft drink-to-ready-made cocktail maker A.G. Barr (BAG) has seen a robust performance through major retailers during the Covid crisis and could also benefit from the reopening of the on-site hospitality market and the recovery in high street and hospitality footfall.

Unsurprisingly, the Irn-Bru-to-Strathmore water supplier posted a fall in revenue and earnings for the year ended 24 January 2021 and said the immediate outlook remained ‘uncertain’, yet AG did suggest it plans to restart dividends during the current financial year.

Other beverages names tied to reopening include Britvic (BVIC), the company behind Wimbledon’s signature tipple Robinsons, Fruit Shoot and Tango, which also produces and sells Pepsi, 7UP and Lipton Ice Tea in Britain and Ireland under exclusive agreements with PepsiCo, not to mention Nichols (NICL:AIM), the robustly financed company behind the Vimto brand.

‹ Previous2021-04-08Next ›

magazine

magazine