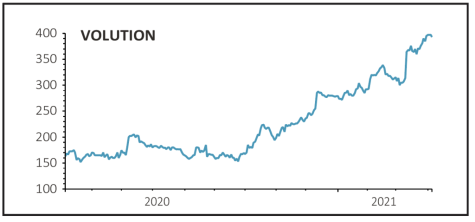

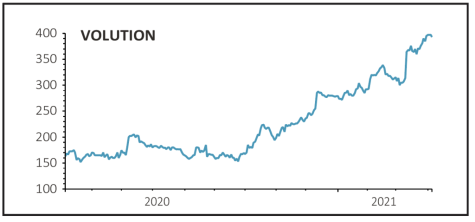

Volution (FAN) 400p

Gain to date: 121.6%

Original entry point: Buy at 180.5p, 9 July 2020

Ventilation products firm Volution (FAN) has been a superb performer since we added it to the Great Ideas portfolio last summer.

We were right to conclude that demand for its portfolio of solutions would be supported by Covid-19 with the latest evidence coming in the form of very strong first half results (11 Mar).

The company upgraded forecasts alongside the numbers which showed that for the six months ended 31 January 2021, pre-tax profit increased by 18.8% to £14.2 million year-on-year.

Volution provided an interim dividend of 1.9p per share, citing strong profitability, free cash generation and confidence in its prospects.

In a recent initiation note on the company Irish stockbroker Davy observed: ‘Ventilation and air quality are of increasing importance to modern society and the expanding Volution is a leader in this category.

‘There is a deepening international dimension to its operations plus the group’s ambition is supported by consistently high free cash flow.

‘It successfully navigated the challenges related to the pandemic, and we believe Volution can increase earnings by an average of circa 20% per annum between 2020 and 2023.’

SHARES SAYS: Still a buy.

‹ Previous2021-04-08Next ›

magazine

magazine