Global multi-national businesses with billions of pounds in revenue and profit aren’t obvious candidates for sympathy but it’s hard not to feel a bit sorry for AstraZeneca (AZN) after its experience over the last six months.

In partnership with Oxford University, AstraZeneca has developed a Covid jab in record time which can be easily stored and transported and, unlike other vaccine developers, agreed initially to produce it at cost.

Yet the Anglo-Swedish firm has found itself a political football, as prominent politicians in the EU in particular have cast aspersions on AstraZeneca and its vaccine, and seen its share price slump over the last six months.

In some respects the company has been the author of its own misfortune. Its communication has been poor in some areas, heightening legitimate concerns over possible side effects associated with the vaccine and its overall efficacy.

The latest blow for the company came amid reports the medicines watchdog in the UK is set to follow the example of European countries and restrict the use of the jab in younger populations over concerns about rare blood clots.

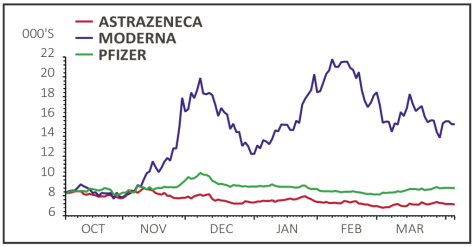

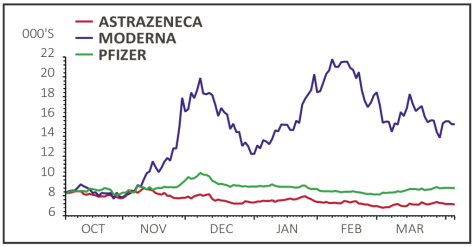

UNDERPERFORMING OTHER VACCINE DEVELOPERS

It has also struggled to deliver on what it promised in terms of doses, though it is hardly alone in this, others have grappled too with the inevitably highly complex process of producing vaccines.

Yet its shares have come in a distant third behind other prominent vaccine names Moderna and Pfizer, both of which are set to book big profits from their own jabs in 2021.

Astra has even said it will sell doses on a non-profit basis to the developing world in perpetuity. Given the need for every country to be inoculated if we are going to get out of the pandemic this is a critical pledge.

Against such a backdrop executives and employees at AstraZeneca may be left wondering where the rewards for good corporate behaviour promised by the growing prominence of investing along ESG (ethical, social, governance) lines, a topic discussed in our recent feature, have disappeared to.

The spotlight put on public companies and the pressure from shareholders to do the right thing has been a very positive development in the past few years and has been reinforced by the better returns delivered by ESG-compliant businesses.

It would feel like a significant step backwards if this link was undermined by a high-profile example of a company looking to do its bit for the good of the world and getting brickbats instead of plaudits.

‹ Previous2021-04-08Next ›

magazine

magazine