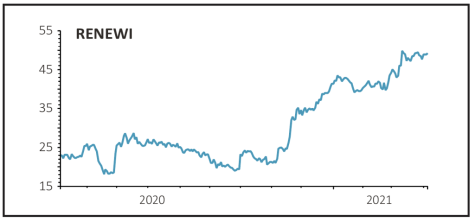

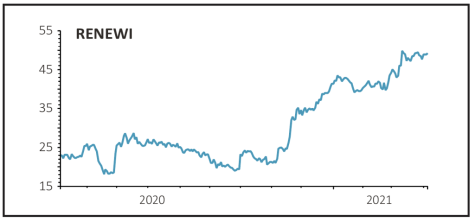

Renewi (RWI) 49p

Gain to date: 105%

Original entry point: Buy at 23.95p, 19 November 2020

Our call to back the self-help programme at Anglo-Dutch waste management firm Renewi (RWI) has paid off faster than we expected, more than doubling our money in less than six months.

With no shortage of good ideas out there we think it is time to book profit and move on.

Volumes in the Minerals and Waste division have grown as hoped, while cost savings from the Renewi 2.0 programme are flowing through and earnings for the year to the end of March are set to hit the firm’s upgraded guidance.

Going forward, the firm expects another year of overall waste volumes below pre-pandemic levels in the Benelux region but says it’s too early to assess the financial impact.

Meanwhile, the increase in margins from the shift from incineration to more sales of high-grade secondary building materials will take time, as will the recovery of lost sales at the hazardous waste unit.

SHARES SAYS: After such a dramatic re-rating of the shares, and with a tough year still in prospect, it’s time for us to bank our winnings and move on. Though long-term investors may want to book some profit and keep at least portion of their position running.

‹ Previous2021-04-08Next ›

magazine

magazine