Travel stocks have reacted positively as the Government confirmed plans for a traffic light system to allow international travel to resume.

The current restart date for international travel and holidays abroad is 17 May, and from that date there will be a list of green, amber and red countries whereby travel to and from green countries will require no isolation period, amber countries will likely require a 10-day quarantine but early release with a negative test and red countries where a 10-day quarantine will be mandatory regardless of Covid status.

Given popular destinations like Portugal and Malta are set to be on the ‘green list’, investors were relatively upbeat on the return of holidays with shares in tour operators TUI (TUI) and Jet2 (JET2) and British Airways owner International Consolidated Airlines (IAG) up over 2% the day after the announcement, while online package holiday provider On The Beach (OTB) soared more than 7%.

However, the reaction wasn’t as positive as it might have been with details over amber countries still unclear. Covid-19 and vaccination rates mean the likes of Spain, Greece and Turkey – where TUI and Jet2 in particular make most of their money – are likely to be put on the ‘amber list’.

More details will be provided by the Government following the release of a report from the Global Travel Taskforce on 12 April, but travel industry bosses reacted with dismay to what they called a lack of clarity from Government.

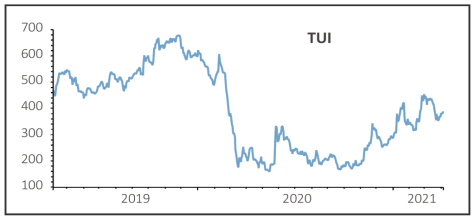

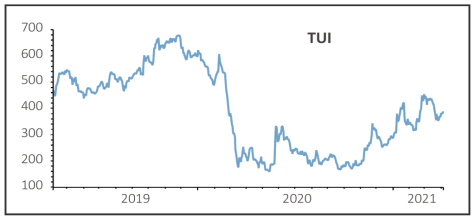

A lack of clarity is also what has led analysts at broker Berenberg to share significant concerns regarding TUI.

The analysts say: ‘We continue to believe TUI faces an uncertain future with a capital structure which is unsustainable, significant debt maturities rapidly approaching, doubt about the resumption of operations and continued meaningful cash burn.’

TUI currently has net debt of over €7 billion, putting it on a highly uncomfortable forecast net debt to earnings ratio of six times for 2021. Ratios of three or less are typically considered sustainable.

The Anglo-German firm is betting heavily on a recovery in foreign holidays this summer but is a prime candidate to raise more cash to stay afloat. As of 3 February, it had €2.1 billion in liquidity and monthly cash burn between €250 million and €300 million.

For all the concerns over TUI, there’s an argument in Germany that the company is seen as ‘too big to fail’, having been bailed out by the German government three times so far during the pandemic and received almost €5 billion in state support.

‹ Previous2021-04-08Next ›

magazine

magazine