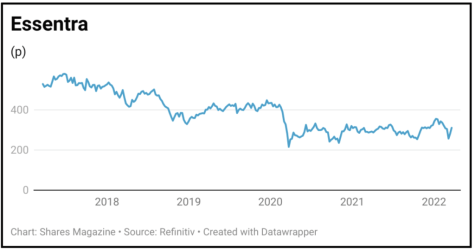

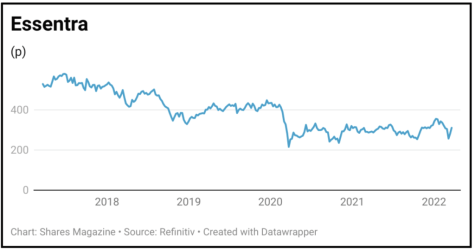

Essentra (ESNT) 310p

Gain to date: 0%

Original entry point – BUY at 310p, 11 November 2021

The key focus for the market when Essentra (ESNT) reported full year results (18 Mar) was management confirmation on the timescales for the strategic exit from both its packaging and filters arms.

In October 2021 Essentra announced that both divisions would undergo a strategic review and be divested in the second quarter of 2022, at the earliest.

Essentra’s packaging business has been successfully turned around and now offers a focused proposition in secondary healthcare packaging. It will be an attractive asset to many potential buyers.

However, Essentra filters is a more difficult sell. If no cash buyer is found, Essentra will try to combine it with a competitor or spin it off.

Following the disposals, Essentra will become a standalone components business.

The components peer group which includes companies like Electrocomponents (ECM), and Diploma (DPLM), trade at a clear premium to Essentra.

Indeed, the peer group trades on an average enterprise value/earning before interest, tax depreciation and amortisation of 14.4 times. This compares with Essentra that trades on a comparable multiple of around seven times.

SHARES SAYS: Keep buying.

‹ Previous2022-03-24Next ›

magazine

magazine