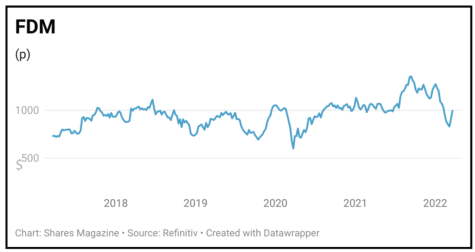

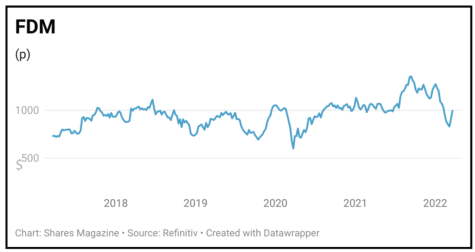

FDM (FDM) £10.02

Loss to date: 15.7%

Original entry point: Buy at £11.88, 20 January 2022

A clear example of how some share prices have become detached from the fundamentals, FDM (FDM) is making the most of its ability to plug IT skills shortages, as we said it could. Results for full year 2021 saw the company’s adjusted operating profits rise 11% to £47.3 million on stable revenues of £267 million, although surpassing expectations of analysts on the latter metric.

The share price had lost 35% in 2022 before the recent sharp rally.

Investors should also note strong utilisation of its IT consultants, or ‘Mounties’, at 97.3% versus 94.8% in 2020, while 78 new client wins (up from 52 year-on-year) augurs well for 2022 results. Stifel also notes that 2,410 new consultants completed training in 2021, 80% up on the year before at setting a new company record.

Many of those new consultants will get dropped into FDM’s largely financial services customers who are clearly investing heavily in digital transformation and security, the latter driven in part by the elevated security risks that have emerged as part of the Ukraine conflict.

Analysts are forecasting around £50 million adjusted pre-tax profit this year (£46.7 million 2021), rising to around £56 million in 2023.

SHARES SAYS: A reliably high-quality business perfectly placed, FDM shares remain a firm buy.

‹ Previous2022-03-24Next ›

magazine

magazine