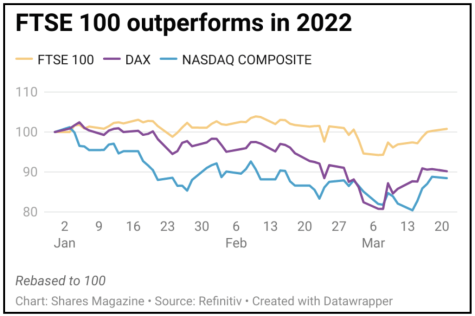

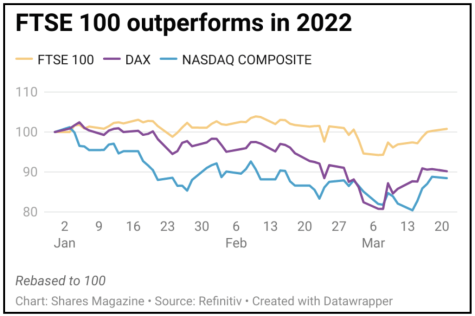

As the first quarter draws to a close most investors will be hoping for less turmoil for the remainder of 2022, with major markets sitting well below where they started the year.

For example, the S&P 500 is down around 7% while the technology driven Nasdaq 100 is off 12%, as higher interest rates take a heavy toll on growth stocks.

In Europe Germany’s Dax and France’s CAC 30 are both down around a tenth. These performances make the UK’s blue-chip FTSE 100 index stand outs given it almost unchanged.

The mid-cap FTSE 250 and FTSE All-Share are down 12% and 3% respectively.

The FTSE 100 index has benefited from its high exposure to booming industrial metals prices and other commodities impacted by the invasion of Ukraine.

Rising energy and metals prices will create upward pressure on near-term inflation, possibly creating a period of stagflation (high inflation and low growth).

Research from investment bank Jefferies looked at prior periods of stagflation and the evidence showed UK inflation-linked bonds and precious metals miners outperformed the market.

The UK market is also attractive from a relative valuation perspective according to Invesco’s global asset allocation team.

Having reduced equity exposure to ‘neutral’ in November 2021, the bank has now moved back to an ‘overweight’ stance.

Invesco expect the best returns to be generated by UK and Emerging market equities over the coming year and have allocated those regions ‘maximum overweight’.

‹ Previous2022-03-24Next ›

magazine

magazine