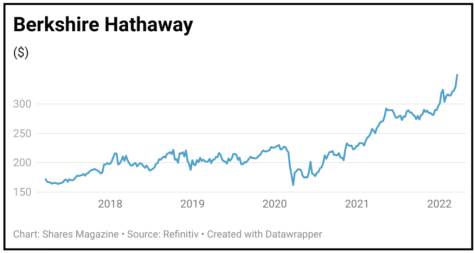

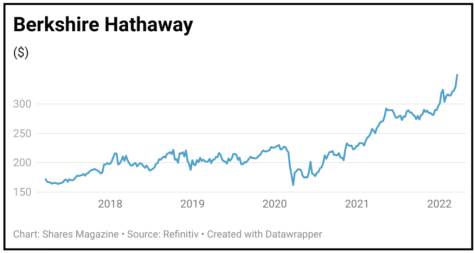

Berkshire Hathaway $352.5

Gain to date: 10.2%

Original entry point: Buy at $320, 17 February 2022

Our bullish call on Warren Buffett-run Berkshire Hathaway is paying off handsomely, with the trade 10.2% in the money as the B shares test new highs. Berkshire Hathaway has been bid up during the recent market turmoil with rattled investors keen to access its diverse portfolio of financially strong and market leading businesses.

The market responded positively to news (21 Mar) of the $11.6 billion purchase of insurance company Alleghany Corporation. This is Berkshire’s biggest acquisition in almost seven years and we are pleased to see the multinational conglomerate deploying some of its enormous cash pile.

A business run by CEO Joseph Brandon, a long-time friend of Buffett’s, Alleghany will be added to Berkshire Hathway’s portfolio of insurance brands that includes GEICO and General Re.

As outlined in our original thesis, Berkshire Hathaway is a great vehicle for achieving a ready-made exposure to a diverse group of some of the best companies in the US and increasingly, elsewhere in the world, in sectors spanning railroads, confectionery, home furnishings, house building, insurance and energy.

SHARES SAYS: Still a sound defensive option for investors.

‹ Previous2022-03-24Next ›

magazine

magazine