Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Berkshire Hathaway readies itself for another home run

No investment style works year in, year out and even Warren Buffett’s Berkshire Hathaway (BRKA:NYSE) has fallow spells in its history. Indeed, the so-called Sage of Omaha freely acknowledges this in his latest Letter to Shareholders, when he notes: ‘During the 2019-23 period, I have used the words “mistake” or “error” 16 times in my letters to you.’

Such humility is commendable, especially as some would use a 60-year record of a 19.9% compound annual gain in Berkshire’s market value as reason for at least a smidgeon of drum-beating, especially when it beats the 10.4% compound annual total return from the S&P 500 hands down.

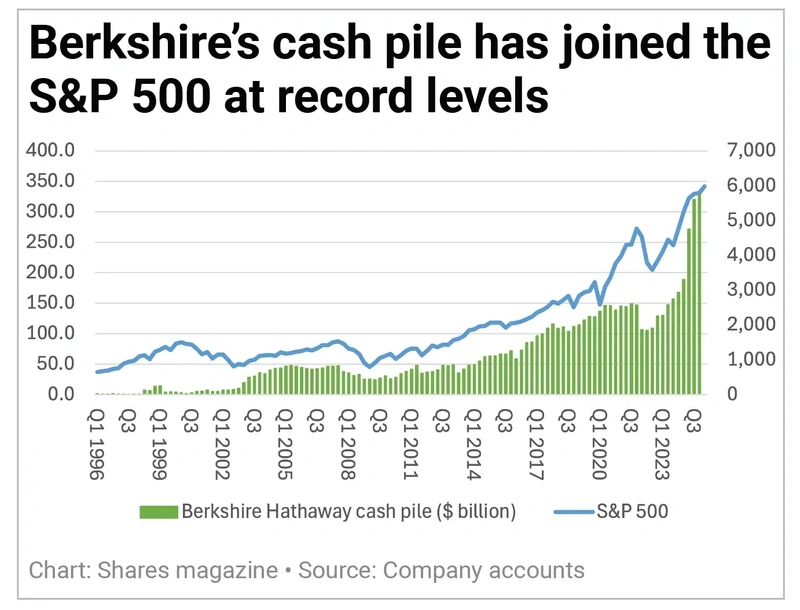

Even those stellar numbers are not enough to persuade everyone that Buffett is, at 94, still a fount of market wisdom (and there is something in the argument that there is a certain irony that tens of thousands of investors turn up at Berkshire’s annual general meeting and call themselves contrarians in the process). But even hardened sceptics must surely be intrigued by how Berkshire Hathaway has sold US equities for nine consecutive quarters, doubled its cash pile in the past year and taken the equity portion of the total portfolio down to its lowest mark since the third quarter of 2017.

DOUBLE PLAY

None of this constitutes advice as to whether to research Berkshire Hathaway’s shares with a view to buying or avoiding them. That is something that investors can only do for themselves, within the parameters of their own personal strategy, time horizon, target returns and appetite for risk. But the manner in which the investment company continues to run up a cash pile and liquidate both its US treasury and US equity holdings is eye-catching.

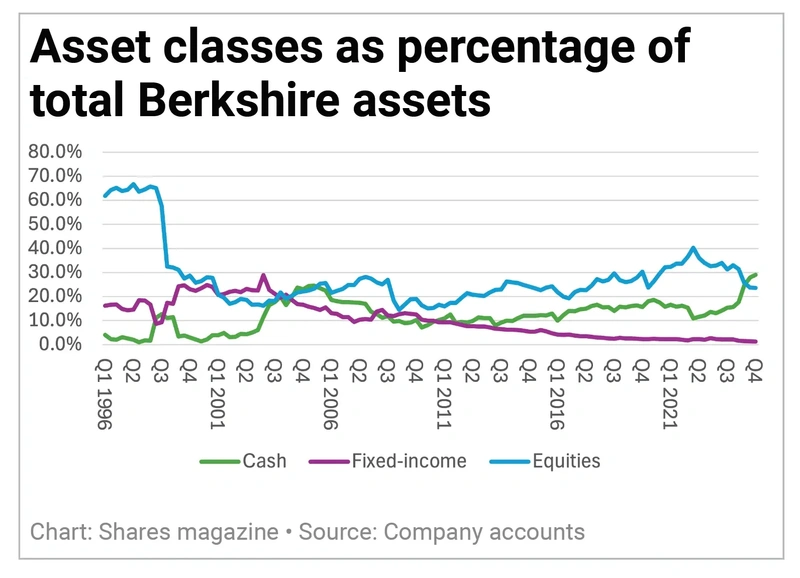

US treasury holdings have consistently dropped as a percentage of the total portfolio for a couple of decades. This may reflect concerns over the fiscal incontinence of successive US administrations, and especially recent ones, with the result that the federal debt continues to balloon. It may simply reflect how Buffett and his associates feel US equities and businesses offer better long-term potential for capital appreciation than fixed-income securities where nominal returns are, by definition, pre-determined by the coupon on offer.

The decline in the equity allocation is what really stands out, mainly because Berkshire did something similar as the technology, media and telecoms bubble inflated and then burst at the turn of the century. It then repeated the trick, to even greater effect, shortly afterwards as US financial markets partied their way headline into the Great Financial Crisis of 2007-09. Lo and behold Buffett, whose aphorisms often mention baseball, who was primed to strike with the cash to pick up bargains galore during and after the smash.

On both occasions, Buffett and his team, which then included the company chair, Charlie Munger, who sadly passed away in 2024, noted animal spirits and lofty valuations. They acted accordingly, exactly as Buffett’s well-known mantra: ‘We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.’

BASES LOADED

Buffett is not guaranteed to be right in his apparent view that US equities are richly valued, and shrewd readers will note that he was (very) early when he began to reduce exposure in the late 1990s and then the early stages of the first decade of this millennium. The market kept on going up as the bull market carried on unabated – only for the reckoning to come in the end for those who focused only on reward and not enough on potential risk.

Again, though, this is at least in keeping with Buffett’s disciplines. ‘We have no idea – and never have had – whether the market is going to go up, down or sideways in the near or intermediate-term future,’ is another one is his lines from a shareholder letter.

The equity sales of the 1990s and early 2000s show as such, but the long-term outcome was the one he ultimately sought.

This is reminiscent of another Wall Street great, although on this occasion Lou Mannheim is a fictional one. He appears in Oliver Stone’s 1987 film Wall Street and is the senior broker at the firm that takes on the young, thrusting Bud Fox who eventually falls in (and then out) with corporate raider Gordon Gekko. Played by Hal Holbrook, the veteran notes Fox’s early successes and tersely notes: ‘Quick buck artists come and go with every bull market, but the steady players make it through the bear market.’

A succession of intriguing episodes in the past few years, from GameStop (GME:NYSE) and meme stocks to silver, from cryptocurrencies to AI stocks and from SPACs to single-day options, all suggest animal spirits are very prevalent again, even if interest rates and returns on cash and bonds are no longer at rock bottom. It will be interesting to see if Buffett (and Mannheim) are proved right once more – and if so, when, given how US equities trade on multiples of earnings seen only rarely and with ultimately unpleasant consequences when they did.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Feature

Great Ideas

Investment Trusts

News

- Rolls-Royce shares hit yet another 52-week high

- Severfield shares plummet after structural steel group delivers another profit warning

- Trump action on crypto, tariffs and Ukraine shifts markets

- Adobe may need narrative change to fire stock higher

- Can engineering outfit Spirax revive its fortunes?

- Tesla looks to AI and robotics to end stock’s three-month slump

magazine

magazine