Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

The loophole that gives your child a £36,000 tax-free allowance this year

A quirk of the system means that families can pay £36,000 into a tax-free account for their child in one year – far exceeding the usual £9,000 annual Junior ISA limit.

A clash between how the rules differ between Child Trust Funds and Junior ISAs, plus the generous £9,000 annual allowance per child, means that parents can exploit the loophole to save a huge amount of money in 12 months, or less. It makes it one of the most generous savings limits out there.

To be eligible the child must already have a Child Trust Fund (see explainer below) and clearly the parents need to have £36,000 that they want to save for their children. But for wealthy families looking to do some tax planning it’s a good move.

A Child Trust Fund (CTF) is a tax-free savings account set up by the UK government for children born between 1 September 2002 and 2 January 2011. The government initially contributed money to these accounts to encourage saving for a child’s future.

The account is held in the child’s name, but a parent or legal guardian manages it until the child turns 16. At 18, the child gains full control and can either withdraw the money or continue saving it in another account.

CTFs were replaced by Junior ISAs in 2011, but existing accounts remain active, and those who have one can still manage or transfer them.

THE MECHANICS OF IT

Where a child holds a Child Trust Fund they can pay up to £9,000 a year into the account. Unlike Junior ISAs, their allowance renews on their birthday, not at the start of the new tax year. It means you can put £18,000 away for a child during the tax year – £9,000 just before their birthday and £9,000 after their birthday.

This £18,000 Child Trust Fund (plus any pre-existing money in the account) can then be transferred to a Junior ISA. Once the transfer is complete (an individual cannot hold a Child Trust Fund and Junior ISA simultaneously) parents can then make a further £9,000 contribution into the Junior ISA, regardless of the fact they have made contributions to the Child Trust Fund in the same year. This will utilise their Junior ISA allowance for the current tax year, leaving £27,000 in their Junior ISA – plus any contributions from previous years.

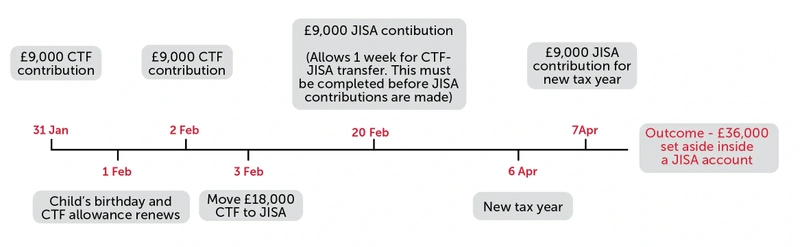

Let’s take the example of a child born on 1 February who has a Child Trust Fund. The parents could make a £9,000 contribution to the Child Trust Fund on 31 January and then make another £9,000 contribution on 2 February. They could then transfer that account to a Junior ISA on 3 February.

As they get a fresh annual allowance from moving to the Junior ISA, they can contribute another £9,000 once the transfer is complete. And then a couple of months later, when the new tax year hits on the 6 April, they can make yet another £9,000 contribution into the Junior ISA. All in that’s £36,000 saved in a tax-free account in a matter of months.

At the beginning of the new tax year, the new £9,000 Junior ISA allowance can be used to make a further contribution, taking the total to £36,000 in just a short period of time, depending on how close the child’s birthday is to the end of the tax year.

Clearly it depends when the child’s birthday is as to how quickly you can funnel that £36,000 into the accounts. And it might not be possible for those children who are born just before tax year end, as their parents may not have enough time to make the second Child Trust Fund contribution, transfer the account to a Junior ISA and make the first Junior ISA contribution before the tax year end. But for anyone not born at the start of April it makes for a pretty attractive wheeze.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Feature

Great Ideas

Investment Trusts

News

- Rolls-Royce shares hit yet another 52-week high

- Severfield shares plummet after structural steel group delivers another profit warning

- Trump action on crypto, tariffs and Ukraine shifts markets

- Adobe may need narrative change to fire stock higher

- Can engineering outfit Spirax revive its fortunes?

- Tesla looks to AI and robotics to end stock’s three-month slump

magazine

magazine