Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Under water: Catch the below pre-Covid level stocks which can rise to the surface

Just over five years ago the stock market began to react in earnest to news of the Covid pandemic.

The sell-off was short and sharp, with a modest recovery from the lows in the spring followed by sharper gains in November 2020 after AstraZeneca (AZN) made a vaccine breakthrough.

However, a large number of UK stocks are still trading below the levels they were at by the close of trading on 21 February 2020, before the selling started in earnest.

In this article we reveal a list of the laggards in the large- and mid-cap space and analyse the data to look for different trends. We also reveal three names which we think are unfairly languishing below their pre-Covid levels.

We also examine the worst of the worst performers and highlight the names which have performed best over the same five-year timeframe. Read on to discover more.

LARGE-CAP HOSPITALITY, TRAVEL AND ASSET MANAGEMENT FIRMS STRUGGLE

Large caps have not been spared the worst effects of Covid and the post-pandemic surge in inflation and interest rates which followed.

Hospitality has had to deal with rising wages and an increase in the national living wage and employer national insurance contributions.

These challenges are reflected in Premier Inn owner Whitbread (WTB) shares, which are languishing more than a third below 2020 levels.

Housebuilders have endured the double-whammy impact of rising cost of mortgages, slowing demand, while increased cost of materials has dented margins.

It is therefore not surprising see housebuilders trading well below 2020 levels with Persimmon (PSN) and Vistry (VTY) two of biggest losers, down 63% and 58% respectively over the last five years.

Property companies have been impacted by higher interest rates which reduce property valuations, while the shift to hybrid working has not been helpful for occupancy levels. This explains why Shaftesbury Capital (SCH) and British Land (BLND) shares sit below 2020 pre-pandemic levels.

Online food retailer and technology company Ocado (OCDO) briefly became one of the big winners from lockdown, sending the shares from around £10 in February 2020 to a peak of £26 a year later.

We are a long way from those dizzy heights with the shares sitting 72% below the levels where they were in 2020. Embarrassingly the company also got demoted from the FTSE 100 index in the process.

The excitement around the game-changing tie-up with US grocery giant Kroger (KR:NYSE), licensing its whizzy automated warehouse technology seems to have faded.

The cost-of-living crisis has taken its toll on consumer sentiment in recent months, impacting consumer facing firms like JD Sports Fashion (JD.) whose shares are down 54% over the last five years.

Medical products company Smith & Nephew (SN.) has been stymied by the backlog of knee and hip replacement procedures which were postponed during lockdown, leaving its shares trading 46% below 2020 levels.

Travel came to an abrupt halt during the pandemic as countries closed borders to prevent entrance of new strains of Covid.

While the industry has since witnessed a boom from revenge spending, shares in Jet2 (JET2:AIM), British Airways owner International Airlines Group (IAG) and cruise company Carnival (CCL) remain under water over the last five years.

Asset managers have struggled to adapt to a higher interest rate environment which means customers can now earn a decent return on cash deposits for the first time in years. Outflows from equites have put pressure on share prices across the sector. [MG]

CONSUMER-FACING MID CAPS UNDER THE COSH

Mid caps whose fortunes are indelibly linked to the struggling consumer, the hard-pressed and disrupted hospitality industry and overseas travel have found the road to recovery long, winding and rocky indeed. The likes of global food travel expert SSP (SSPG), travel retailer WH Smith (SMWH) and European airline Wizz Air (WIZZ) all languish significantly below pre-Covid levels, while Magners-to-Menabrea maker C&C (CCR) and premium mixer drinks firm Fevertree (FEVR:AIM) remain in the share price doldrums, down 50%-plus on a five-year view.

Indebted SSP, which operates restaurants, bars, cafes and other food and drink outlets at airports and railway stations under brands such as Upper Crust, Ritazza and Le Grand Comptoir, has not been helped by geopolitical uncertainty, industrial action and adverse currency swings, while shares in storied WH Smith trade at half the level of five years ago. The retailer is looking to hive off its High Street arm, having successfully repositioned itself as a pure-play travel retailer, at a time when bricks-and-mortar retailing faces online competition, subdued footfall and a sharp rise in labour costs following the recent UK Budget.

Also trading well below pre-pandemic levels are pubs groups JD Wetherspoon (JDW) and Mitchells & Butlers (MAB) as customers continue to grapple with cost-of-living pressures. Sentiment towards these names has hardly been helped by Rachel Reeves’ Budget, with investors concerned about the bottom-line impact from increased National Insurance costs and another rise in the National Living Wage.

Retail was a tough enough sector to occupy pre-Covid, but subsequent inflation and higher interest rates have crimped consumers’ purchasing power and its constituents are groaning under the strain of rising costs. This largely explains the presence of tech products purveyor Currys (CURY) and UK pet care leader Pets at Home (PETS) on the five year mid cap fallers list, though the former has staged an impressive rally more recently on takeover interest, consistently strong trading and a return to the dividend list, while bid whispers have boosted shares in the latter.

Shares in recruiters Hays (HAS) and PageGroup (PAGE) are 55.1% and 28.8% lower on a five-year view respectively, with candidate and client confidence subdued amid macro-economic uncertainty in many of their markets. However, the biggest five-year faller is Aston Martin Lagonda (AML), the iconic-yet-indebted car maker whose shares are down almost 90% having hit a series of speed bumps since joining the stock market in 2018. Company-specific challenges, consistent losses, the knock-on effects of weaker consumer demand and more recently, falling business confidence in China, are among the myriad of factors that have dragged on this FTSE 250 loser. [JC]

WHO HAS SHONE IN THE FIVE YEARS SINCE COVID HIT?

In some respects it’s harder to pick out trends among those businesses whose shares have performed best in the five years since the Covid correction began.

Some initial Covid winners like online fast fashion firms ASOS (ASC) and Boohoo (BOO:AIM) have endured a big slump since.

Publisher Pearson (PSON) has held on to its gains – up 142% as the group successfully accelerated its digital first strategy and reaped the rewards of offering online learning through various products and its Virtual Schools division – demand for which grew sharply during the pandemic.

In Pearson’s latest full year trading update (on 16 January) the company said Virtual Learning sales had fallen back by 5% in the fourth quarter.

Fellow publishing group Bloomsbury (BMY) benefited from people rediscovering their love of reading during lockdown.

It then struck gold signing new romantasy author Sarah J. Maas and has carved out a meaningful presence in academic publishing, bolstered by its acquisition of assets from US outfit Rowman & Littlefield for £65 million, adding 40,000 academic titles to its library last May.

Cakes, custards, and cooking sauces maker Premier Foods (PFD) has seen its shares rise 427% over a five-year period.

A combination of factors has led to this big move higher – a decade-long balance sheet rehabilitation giving it extra financial firepower and paving the way for further debt reduction and a progressive dividend after a 13-year absence.

Aero-engine maker Rolls Royce (RR.) has proved itself to be the true ‘comeback kid’ after Covid with shares gaining 176% over five years.

Rolls Royce shares recently hit a new record high of 725.4p on the back of excellent full-year results and upgraded targets.

On 27 February, the company reported a significant strengthening of its balance sheet, a £1 billion share buyback and a reinstatement of its dividend – the last time the company paid a dividend was in January 2020.

Further down the list of gainers is uranium mining company Yellow Cake (YCA:AIM) which has benefited from the ‘buzz’ around the future of nuclear power and fantasy miniatures creator Games Workshop (GAW).

The maker of the hit tabletop fantasy game Warhammer entered the FTSE 100 in December 2024, three decades after making its debut on the London stock market. Over the past five years, Games Workshop shares have gained 98.9% giving it a market cap of an impressive £4.76 billion. With a tie-up with tech giant Amazon (AMZN:NASDAQ) expected in the near future – to create films and a TV series based on the Warhammer 40,000 universe – there’s plenty of excitement around this Nottingham-based company. (SG)

THREE UNDER-WATER STOCKS WHICH CAN RISE TO THE SURFACE

Genus (GNS) £18.20 Market cap: £1.2 billion

It was almost as if the pandemic did not happen for animal genetics company Genus (GNS) which was riding high after delivering record pre-tax profit of £38.7 million for the half year to 31 December 2020.

Continued royalty growth and high breeding stock sales in China contributed to 11% volume growth in PIC (Pig Improvement Company) while Bovine genetics business ABS (American Breeders Service) delivered 17% revenue growth.

A key driver for the pig business was expansion in China where breeders were restocking pig herds following the spread of Swine Fever in 2019. That progress was interrupted when China was hit by a slump in pig prices which fell by two thirds between December 2020 and June 2021 due to an oversupply of pork and low consumer demand.

That marked the high for Genus shares, which peaked at £60 in August 2021. Ongoing volatility in the Chinese pig market continued to act as a drag on the overall business, holding back growth in pre-tax profit.

Fast-forward to January 2025 and the business delivered its first positive trading surprise and profit upgrade for three years. First half adjusted pre-tax profit grew 21% to £35.4 million and cash flow from operations surged 284% to £46 million.

PIC China won a further seven new royalty customers taking the number to 20 over the last 18-months. We sense Genus is entering a new earnings growth upcycle after the lull of the last three years.

Shore Capital’s Sean Conroy raised his financial year 2025 pre-tax profit estimate by 5% to £67.3 million after the January trading update.

Commenting on the first half results (27 February) Conroy said: ‘todays results reinforce our view that Genus has come through its recent downgrade cycle and is entering much more cash generative period.’

With the shares languishing 70% blow the peak, and 46% down on pre-pandemic levels, there is plenty of recovery potential. [MG]

Genuit (GEN) 355p Market cap: £885 million

Investors with a few grey hairs may remember a business called Polypipe, which was acquired by IMI (IMI) in the late 1990s before being bought out by management more than once in the 2000s before listing in 2014 and subsequently changing its name to Genuit (GEN).

The business has since been reorganised to focus on residential, commercial and infrastructure markets, and has grown through acquisition to become the UK’s leading producer of sustainable water, climate and ventilation products.

After a surge in orders between 2020 and 2022 as the RMI (repair, maintenance and improvement) market exploded, Genuit has faced a more subdued demand environment in the last couple of years and more recently delays to some projects, meaning 2024 earnings will be at the low end of market expectations.

However, the business is geared into a nascent recovery in both residential construction and the RMI market, and any recovery in volumes will lead to a significant improvement in margins thanks to operational gearing.

Added to this, the business is highly cash-generative, has a strong balance sheet, and leverage is modest at around 1.1 times earnings.

Several listed housebuilders have already noted a sharp pick-up in enquiries this year, and the government’s push to speed up planning is enabling more developments to come on stream.

Berenberg analyst Robert Chantry says: ‘Genuit has laid out several key medium-term targets: i) organic growth 2-4% ahead of the market, thanks to structural top-line drivers; ii) operating margins greater than 20%; iii) ROCE over 15%; and iv) cash conversion greater than 90%. Genuit is positioning itself as a company with strong structural growth drivers and self-help potential, as opposed to a more cyclical story.’

Given these drivers, a rating of 13.8 times 2025 forecast earnings per share does not seem expensive. [IC]

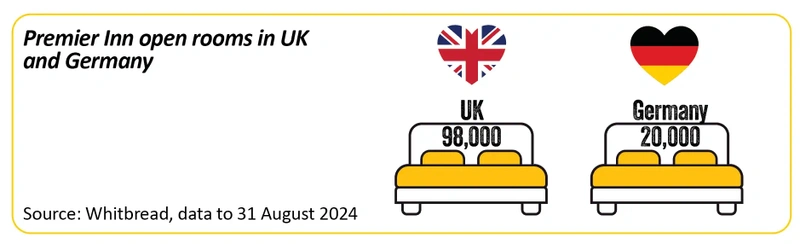

Whitbread (WTB) £26.61 Market cap: £4.7 billion

Like all hotel operators Premier Inn-owner Whitbread (WTB) suffered significant disruption during the pandemic.

However, we think it has emerged from Covid in pretty good shape and arguably with an enhanced competitive position as less robust rivals have either fallen by the wayside or been knocked off track.

As Berenberg analyst Jack Cummings observes: ‘Whitbread’s primary market, the UK, has experienced a contraction in supply, particularly as market conditions have accelerated the decline of the independent hotel sector. We expect market conditions to remain tough for independent operators and Whitbread to continue to grow its share of the market.’

The Premier Inn proposition is highly consistent. This isn’t luxury accommodation but you know exactly what you are getting and its value credentials means it has appeal for commercial and leisure travellers alike.

While net debt remains relatively elevated, the company has the asset backing of its hotel estate and a medium-term ambition to generate £2 billion of cash for dividends, buybacks and investment in the business suggest management is comfortable with the balance sheet position.

Shore Capital analyst Greg Johnson notes the company’s five-year plan could see earnings per share move beyond 300p, from the 226p posted in the year to February 2024 and he highlights the possibility of the company bringing forward capital returns in order to win over the market.

The company’s more nascent business in Germany looks to be approaching a key milestone – anticipated to have reached profitability in the 2024 calendar year. This is another string to Whitbread’s bow for which the market may start giving the company some credit.

Changes in the October 2024 UK Budget will lead to increased costs but, on a forecast price to earnings ratio of 12.4 times – significantly below the historical average, this looks more than priced in. [TS]

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Feature

Great Ideas

Investment Trusts

News

- Rolls-Royce shares hit yet another 52-week high

- Severfield shares plummet after structural steel group delivers another profit warning

- Trump action on crypto, tariffs and Ukraine shifts markets

- Adobe may need narrative change to fire stock higher

- Can engineering outfit Spirax revive its fortunes?

- Tesla looks to AI and robotics to end stock’s three-month slump

magazine

magazine