Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

How I think about my investments in the technology space

Investing in tech stocks has been making money for ordinary investors for years. Since the internet emerged in the early 1990s, the broadly drawn tech space has consistently delivered market-beating growth in revenues and profits and dominated share price returns.

It is no coincidence that aside from Warren Buffett’s Berkshire Hathaway (BRK.B:NYSE), all of the trillion-dollar companies (currently seven), are universally known as ‘tech’ stocks. But crucially, for me, the tech space looks likely to capture the lion’s share of growth in the years to come – higher revenues, larger profits, bigger cash flows, which should mean superior total returns for investors.

Recent research from Aswath Damodaran, a professor of finance at the Stern School of Business at New York University, supports the idea that tech will remain the preeminent growth sector.

Markets use the term ‘tech’ in a fast and loose fashion, and it captures a wide variety of business models, strategies, risks and rewards. Amazon (AMZN:NASDAQ), Netflix (NFLX:NASDAQ) and Tesla (TSLA:NASDAQ) are all considered tech stocks yet they are completely different businesses with different challenges and opportunities.

THREE KEY MEASURES

Focusing on those differences is, I find, generally more helpful that getting hung up on terminology, with three key measures standing out. First, what advantages does a company have over its competitors, and can they be defended? Second, what growth runway does the company have, and are they capable of exploiting it? Third, how profitably is a company scaling up and does it generate large piles of cash? Other factors need to be considered too, obviously, but these metrics make for a decent starting point.

Let’s look at a topical example; Nvidia (NVDA:NASDAQ). After back-to-back triple-digit returns in 2023 and 2024, the chip designer has faced a choppy 2025, so far, as questions are raised over the firm’s future growth, emerging competition and, possibly, the tightening of Washington’s trading handcuffs with China.

There was also Chinese hedge fund-backed start-up DeepSeek releasing R1 in January, its open-source reasoning model that reportedly outperformed the best models from US companies, such as OpenAI. R1’s self-reported training cost was less than $6 million, a fraction of the billions that Silicon Valley companies are spending to build their artificial intelligence models, although there remains healthy scepticism among analysts over those cost claims, and the Nvidia chips that power R1.

The stock market’s reaction was swift. In a single day, Nvidia’s stock lost a record-breaking $600 billion in value, a 17% drop. Nvidia, currently the largest producer of advanced semiconductors used for AI development, continues to face questions about DeepSeek’s impact although Nvidia’s comments in response to R1’s launch indicate that it sees DeepSeek’s breakthrough as creating more demand for its graphics processing units.

The immediate concern is that not as many Nvidia chips will be required to develop AI applications. On the other hand, based on time-tested economic theory, if programming costs decline, demand for chips could rise. Nvidia was always going to face increased competition, it always has, but backers are betting that management can out-develop opponents to stay at the top.

For now, the fundamentals support that view, as recent forecast-beating Q4 earnings showed, even if the markets reacted badly. Nvidia clearly has advantages of rival that can be defended over time, and the growth pathway still looks very healthy and long-term. Is it doing so profitably and cash generatively?

Returns on capital of 87% and operating margins 62% say yes, with free cash flows accelerating too.

TAKING A BROAD VIEW

Away from Nvidia, the broader tech space seems to be in a good place, with the two most crucial sectors on the S&P 500 - Information Technology and Communication Services placed second and fourth in terms of the number of companies to report earnings above estimates during the latest quarterly reporting season (to end December 2024 or January 2025), according to FactSet data at 82% and 8%. Information Technology (83%) saw the largest number of companies to beat the Street on revenues too.

FactSet estimates that total revenue across the S&P 500 is expected to grow at a compound annual growth rate of 8.9% out to 2029, slower than the four sub-sectors identified as tech by the Stern Business School research.

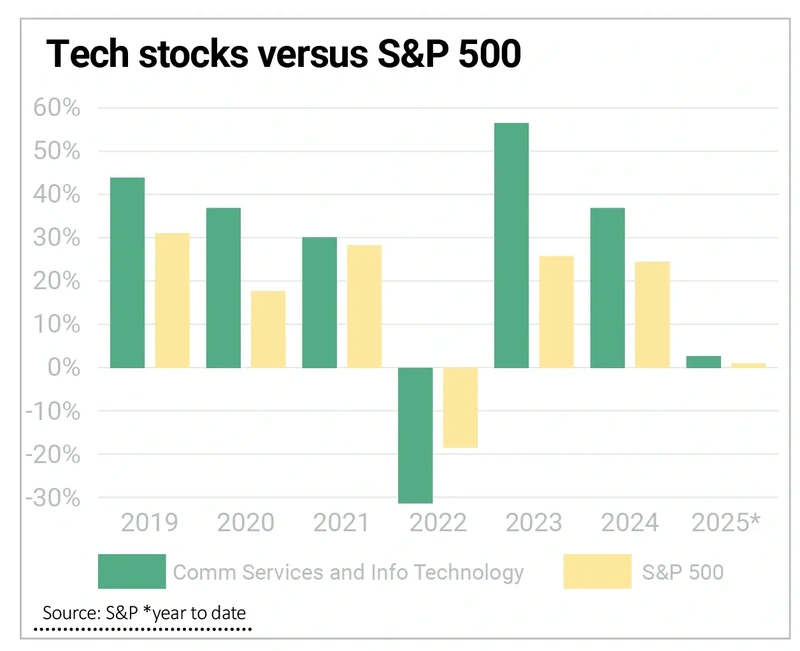

This follows a second consecutive year of stellar technology stock performance, according to US Bank Asset Management. In 2024, the S&P 500 Communications Services and Information Technology index combined gained 37.4%, following 2023’s gain of 57%. By comparison in 2024, the broader S&P 500 Index gained 25%.

Although January’s AI developments added a level of technology sector uncertainty that didn’t exist before, the outlook in general remains favourable, I believe. AI and cloud computing account for a significant portion of today’s corporate spending, as companies seek to enhance productivity and boost their bottom lines.

The information technology spending we’re seeing is not just from consumers, but on a business-to-business basis, says Eric Freedman, chief investment officer for US Bank Asset Management. ‘That’s what companies are spending their capital on, so that’s where we want to be positioned.’

Sure, in the near-term, investors will home in technology stock valuations. High double-digit PEs (price to earnings) multiples often make investors nervous because a lot of good news is already priced in. But in the long run, I believe that there is scope for the best tech stocks to maintain above average growth rates with solid consensus beating potential to provide upside surprises.

It’s why I often look at three-year average PEs and PEGs (price to earnings growth) multiples because I believe they provide a better glance into the future with that extra growth factored in.

Technology companies offer the potential for strong earnings growth that’s not specifically connected to the business cycle, most of the performance US Bank Asset Management sees ahead is driven by secular, rapid business growth, something that tech fund managers have been telling me for a while.

Information Technology stocks currently represent the largest sector of the benchmark S&P 500 Index, comprising more than 30% of the index’s value. When you add in Communications Services stocks, many of which connect with the technology arena, Alphabet (GOOG:NASDAQ) and Meta Platforms (META:NASDAQ), for example, the group represents more than 40% of the S&P 500.

Tech has become so large and influential to almost every aspect of life that investors simply cannot afford to ignore the space. Obviously, you need to be selective, and one way to do that easily to invest in a tech fund run by people with deep experience and expertise, the Allianz Technology Trust (ATT), or Polar Capital Technology Trust (PCT), for example, two investment trusts I am personally invested in. My conversations with lead managers Mike Seidenberg and Ben Rogoff, respectively, plus many others, help me remain optimistic about the technology stocks space.

While you can significant technology exposure by investing in an S&P 500 tracker, given its heavy weighting in the index, these managers have the ability to go overweight and underweight relative to the index to reflect their levels of confidence in the investment case for individual stocks.

DISCLAIMER: The author of this article (Steven Frazer) owns shares in Allianz Technology Trust and Polar Capital Technology Trust.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Feature

Great Ideas

Investment Trusts

News

- Rolls-Royce shares hit yet another 52-week high

- Severfield shares plummet after structural steel group delivers another profit warning

- Trump action on crypto, tariffs and Ukraine shifts markets

- Adobe may need narrative change to fire stock higher

- Can engineering outfit Spirax revive its fortunes?

- Tesla looks to AI and robotics to end stock’s three-month slump

magazine

magazine