Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

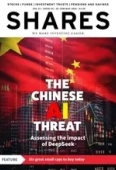

China AI venture DeepSeek comes out of nowhere to upset the apple cart

Who had an open-source Chinese AI chatbot on their bingo card as something which could trip the markets up in 2025? Not me, I have to confess. We have a news special on the DeepSeek story and its implications from my colleague Martin Gamble, who won’t mind me saying has seen a few market cycles in his time.

Anyone invested in a global fund or tracker will likely to have some exposure to this story and they might understandably be somewhat concerned about the sell-off. Remember corrections are normal and healthy even if they don’t feel that way in the short term.

The concentration on and weighting afforded to AI plays on the US market, in particular, means we will inevitably see a much larger impact there than we might here, for example, where the FTSE 100 has remained pretty steady over the last couple of days.

We are still some way off knowing the full implications of DeepSeek’s launch and the selling seems to have been short-lived for now but, as we discuss, the lofty valuations afforded US stocks means they are vulnerable to this sort of setback.

Interestingly, one asset class which has been popular as a store of wealth for centuries seems to be back in favour with gold close to testing new record highs.

The precious metal has had a stellar run in recent years, supported thanks to its role as an inflation hedge and a safe haven during a period of elevated geopolitical uncertainty while buying by central banks looking to diversify their reserves out of dollars has been another driver.

We have one observation to make - this recent leg up has happened during a period of dollar strength, so given it is denominated in dollars, gold would likely get a boost if the US currency were to reverse any of its recent gains.

From some of the largest companies in the world to some of the littlest, this week’s Shares turns its attention to some of our best small-cap ideas.

Obviously higher-risk, nonetheless they have the potential to deliver outsized returns. You can read why the team have made their respective selections and why they are excited about them in our main feature this week.

One further observation - small caps are very definitely not overvalued. Constituents of the MSCI UK Small Cap index trade on a forward price-to-earnings ratio of less than 12 times compared with more than 19 times for names in the MSCI World index.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Dan Coatsworth

Feature

Great Ideas

Investment Trusts

My Portfolio

News

- Everyman Media plumbs the depths after registering all-time low

- Will Diageo shareholders be raising their glasses or downing their sorrows?

- Can Palantir keep the plates spinning as its valuation balloons?

- WH Smith hangs ‘for sale’ sign over historic High Street stores

- Sage Group hits new high after 2024 results and buyback spur gains

- US technology stocks tumble on surprise Chinese AI innovation

magazine

magazine