Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

It’s time to cash in our ‘Get Out Of Jail’ card in Burberry

Burberry (BRBY) £12.01

Loss to date: 7.2%

When we suggested buying shares in UK fashion house Burberry (BRBY) at £12.94 in February 2024, little did we know the bottom was about to fall out of the luxury goods market.

WHAT HAS HAPPENED SINCE WE SAID TO BUY?

At their nadir in September, after exiting the FTSE 100, the shares closed at 575p handing us a paper loss of more than 55%, but Lazarus-like they have risen from the dead and now sit just over 7% below our ‘in’ price, so excuse us if we collect our coats and head for the exit.

The recovery of the last four months was hastened by better-than-expected results from Swiss luxury giant Richemont (CFR:SWX), owner of top-name brands including Cartier and Van Cleef & Arpels.

The Swiss group reported its highest-ever sales in the three months to December, topping analysts’ forecasts thanks to strength in its jewelry division and sending its shares 17% higher.

Burberry itself surprised the market positively last week with stronger-than-expected sales for the same three-month period, unleashing a similar rally and prompting chief executive Joshua Schulman to proclaim his ‘Burberry Forward’ turnaround strategy to reignite growth was already having an impact.

WHAT SHOULD INVESTORS DO NOW?

Without wishing to rain on anyone’s parade, the three-month consensus was ‘stale’ at best, as Jefferies’ analyst James Grzinic put it, so the bar was artificially low allowing Burberry to clear it with ease.

The comparable sales figure in the final quarter of 2023 was particularly weak, whereas luxury spending in the US saw a surge last quarter following the election, and the firm slashed prices on some of its older stock by up to 50%, helping to drive sales.

As the saying goes, one swallow doesn’t make a summer, and without the benefit of a weak prior year and aggressive discounting we doubt Burberry will be able to repeat the trick next quarter, so it’s time to cash in our ‘Get Out Of Jail’ card, admittedly not for free but for a much smaller loss than we had feared.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Dan Coatsworth

Feature

Great Ideas

Investment Trusts

My Portfolio

News

- Everyman Media plumbs the depths after registering all-time low

- Will Diageo shareholders be raising their glasses or downing their sorrows?

- Can Palantir keep the plates spinning as its valuation balloons?

- WH Smith hangs ‘for sale’ sign over historic High Street stores

- Sage Group hits new high after 2024 results and buyback spur gains

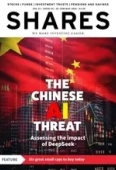

- US technology stocks tumble on surprise Chinese AI innovation

magazine

magazine