Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Trainline should be able to ride out government plans for a state-backed rival

Trainline (TRN) 366p

Gain to date: 11%

Since we flagged the stock’s appeal last February, Trainline shares have been steadily rising and the firm has become the number one travel app in Europe.

The online ticketing platform has shown investors that it has truly recovered both from the pandemic and from the disruption caused by UK rail strikes last year.

Recent results saw net ticket sales rise 13% year-on-year to £3.01 billion for the six months ending 31 August.

WHAT HAS HAPPENED SINCE WE SAID BUY?

Since the company first listed, investors have been aware of government plans to launch a centralised system to consolidate individual train operators’ ticket websites, and last week the topic raised its head again, sending the shares down more than 8% on the day (22 January).

Analysts at Swiss bank UBS called the market reaction ‘exaggerated’, and we are inclined to agree - looking at the government’s plans, it said it would work with third-party retailers to ensure a competitive environment, which suggests Trainline will. be included in any discussions.

‘There will be an industry-wide consultation on the Rail Reform Bill in the coming weeks, but we note that the process of legislating and establishing GBR (Great British Railways), as well as nationalising the carriers, is expected to take several years,’ said Shore Capital analysts in their analysis of the situation.

WHAT SHOULD INVESTORS DO NOW?

We remain positive about the prospects for the online ticketing platform and think investors should sit tight ahead of the full-year trading update in mid-March.

Trainline has a dominant market share in the UK, with 18 million customers and counting according to chief executive Jody Ford, and a growing market share in Europe with combined net sales growth across Spain and Italy of 23% for the six months ending 31 August.

The group recently raised its full year 2025 guidance and now expects annual growth in net ticket sales year-on-year of between 12% and 14% and year-on-year revenue growth between 11% and 13%.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Dan Coatsworth

Feature

Great Ideas

Investment Trusts

My Portfolio

News

- Everyman Media plumbs the depths after registering all-time low

- Will Diageo shareholders be raising their glasses or downing their sorrows?

- Can Palantir keep the plates spinning as its valuation balloons?

- WH Smith hangs ‘for sale’ sign over historic High Street stores

- Sage Group hits new high after 2024 results and buyback spur gains

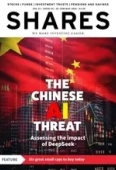

- US technology stocks tumble on surprise Chinese AI innovation

magazine

magazine