Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Netflix shares soar after blockbuster results and big plans to boost advertising income

Streaming giant Netflix (NFLX:NASDAQ) is the talk of Tinseltown after serving up a blockbuster quarter. Earnings smashed expectations and it delivered strong subscriber growth. It’s no wonder the shares soared on the news.

It grew fourth quarter revenue by 16% to $10.2 billion and paid memberships increased by the same percentage to 301.6 million.

Netflix has proved its success is not waning – it is going from strength to strength and continues to be king of the streaming platforms. It has achieved the perfect four – every quarter in the 2024 financial year beat earnings expectations. The last time it achieved that status was in 2018.

PRICES ARE GOING UP

With more people signing up to use its services, the business is looking financially strong and strategic growth plans are yielding great success. It’s not a surprise that Netflix feels comfortable in raising prices. Customers love its content so strike while the iron is hot and get them to pay more.

A monthly subscription to Netflix is still an affordable treat and no more than a round of coffees for a group of four or a few beers after work.

There is good reason to put up prices. Its cash spending on content is set to hit $18 billion in 2025 versus $17 billion last year. The extra money needs to come from somewhere. Netflix has bold plans for how it intends to spend the cash and both viewers and shareholders could benefit.

PLANS TO ADD MORE SPORTING CONTENT

Netflix has been spreading its wings to offer more diversified content. Sports and games now comfortably sit alongside films and TV shows, making Netflix a broader entertainment hub. It means there is something for everyone and the company clearly feels this is worth a higher monthly subscription price.

Sports rights can be incredibly expensive and it makes sense that Netflix has opted to go with special events rather than full season sport packages. There is often a buzz around special events which should help to drive up audience numbers, particularly if everyone is talking about a certain game at work or among friends. It’s a clever move as it means Netflix can be selective with the games for which it wants to obtain the rights, thereby keeping greater control over spending.

Recent boxing and NFL events proved to be a big win for Netflix, entertaining viewers and offering something else in its sales pitch to keep enticing more people to subscribe. Such sporting events are also perfect for attracting advertisers keen to reach a large audience, and this is now a key source of income for the company.

LA FIRE RISKS

The Los Angeles fires haven’t had a meaningful impact on any of its TV and film productions, but it’s a risk to consider if industry people’s lives are turned on their heads if their homes are lost.

Hollywood strikes caused chaos in recent years and led to widespread delays in new releases and Netflix wants to avoid a repeat of that situation. After all, new releases are a key part of its arsenal to keep viewers engaged and attract more of them.

AD INCOME BECOMES MORE IMPORTANT

Nearly all of the main streaming platforms now offer cheaper advertising-led subscription tiers. Consumers can watch content at a lower price point in exchange for being served adverts before and during programmes. These interruptions have become second nature and aren’t a massive turn-off.

Netflix is determined to make advertising a much greater proportion of its overall income and has developed technology to better measure audiences and give advertisers the precise information they desire to support targeted promotions. The company beat its fourth-quarter advertising revenue target and said it had doubled its advertising revenue year-on-year in 2024. It expects to double it again this year, which is a punchy target but a major win if achieved.

BIG HITS OVER THE PAST QUARTER

The company has enjoyed massive success with a wide range of films and TV shows over the past quarter. Black Doves has been the thriller everyone’s talking about; the new season of Outer Banks has kept teenagers hooked; and Carry-On has enjoyed a massive buzz on social media as the new Die Hard-style alternative Christmas movie. The list goes on. It shows that Netflix has proved to be a dab hand at recognising the type of content that keeps people coming back for more.

It’s going large on scripted TV series in 2025. A multi-part series could be 10 hours of content or more, which keeps viewers coming back to the platform and also feels like they are getting value for money.

Already on the slate is the final series of Stranger Things; another round of Wednesday and her spooky antics; and the third series of Squid Game should be a massive driver of subscriber sign-ups in the first quarter as it was only released a few days before the end of the previous quarter.

WHERE NEXT FOR GAMING?

Gaming is perhaps the weak spot for Netflix. It’s been quietly trying to develop a compelling gaming proposition to sit alongside film and TV, but it feels like the service is still finding its feet. During the analyst conference call, management said they continued to refine the strategy on games, which implies things haven’t gone as well as expected.

The focus for gaming is now on milking Netflix’s existing intellectual property, implying we’ll see lots of games featuring characters from its popular shows and movies. Netflix is also trying to recreate the magic of family board game night by launching party-style, play-with-friends video games via the TV.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Dan Coatsworth

Feature

Great Ideas

Investment Trusts

My Portfolio

News

- Everyman Media plumbs the depths after registering all-time low

- Will Diageo shareholders be raising their glasses or downing their sorrows?

- Can Palantir keep the plates spinning as its valuation balloons?

- WH Smith hangs ‘for sale’ sign over historic High Street stores

- Sage Group hits new high after 2024 results and buyback spur gains

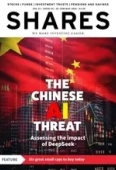

- US technology stocks tumble on surprise Chinese AI innovation

magazine

magazine