Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Can I take tax-free cash from my pension more than once?

I am 64 and retired from my full-time job about four years ago. At that time, I took my tax-free cash from my SIPP.

I haven’t yet taken any other money from my SIPP. Instead, I am working part-time as a consultant which gives me enough money for our needs.

Over the last four years my pension has increased in value. Can I now take more tax-free cash from it?

Blake

Rachel Vahey, AJ Bell Head of Public Policy, says:

Tax-free cash – or a pension commencement lump sum (PCLS) to give it its technical name – is a valuable feature of pension savings.

You can access your pension savings from age 55 (to rise to age 57 from April 2028), and you can take up to 25% of that amount as tax-free cash. The remaining 75% has to provide an income. This could mean moving it into drawdown so you can withdraw the money as and when you want to. Or buying an annuity – a guaranteed income to be paid for the rest of your life. Or take the whole 75% as a taxable lump sum.

If you decide to move your money into drawdown then it remains invested, for you to take taxable income from as and when you choose. You can take as much income as you want – there are no limits. You can take a regular amount or one-off payments.

Drawdown brings flexibility but there are risks that pension savers need to consider. The SIPP remains invested, giving it a chance to keep on growing. Many investors use any growth in their pension fund to provide them with an income so that the SIPP maintains its value. But, of course, if SIPP investments don’t do as well as expected the value of the fund could fall.

Once the pension fund has been moved into drawdown then you cannot take any more tax-free cash from it, regardless of how much it grows through investment. For example, it could double in value, but you still can’t take any more tax-free cash from it.

A pension saver can only take tax-free cash from a pension fund that has not yet been touched or accessed. (This is also called ‘crystallised’. So a pension fund that is untouched can also be called ‘uncrystallised’.)

PAYING IN MORE CONTRIBUTIONS

If you want to take more tax-free cash, then you can do this by paying more contributions into the pension. Most SIPPs will accept new pension contributions in even if the remaining fund is in drawdown. (At least up to age 75 when you can no longer receive tax relief on your pension contributions.)

You can pay personal contributions of up to 100% of your UK earnings and receive tax relief on those contributions. Your employer – if you have one – can also contribute. Indeed, if you earn over £10,000 then given your age (you are over 22 and under state pension age), your employer will have to automatically enrol you into a pension and pay contributions unless you opt out.

There is also an overall annual allowance of £60,000 a tax year which includes yours and any employer’s pension contributions and tax relief. But be aware that if you were to take taxable income from your pension, this allowance is reduced to £10,000.

If you don’t have any earnings, you can still contribute up to £3,600 (including tax relief) each tax year into a pension.

AN ULTIMATE LIMIT ON TAX-FREE CASH

One final point. If you are thinking about paying more money into your pension in order to take further tax-free cash, then you should also be aware there is a limit to the total amount of tax-free cash lump sums someone can take from their pension in their lifetime. This is called the lump sum allowance and is usually £268,275.

When working out how much lump sum allowance you have left, you will need to consider the tax-free lump sums you have already taken from your pension. If you go over your threshold, then the excess will be subject to income tax.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Dan Coatsworth

Feature

Great Ideas

Investment Trusts

My Portfolio

News

- Everyman Media plumbs the depths after registering all-time low

- Will Diageo shareholders be raising their glasses or downing their sorrows?

- Can Palantir keep the plates spinning as its valuation balloons?

- WH Smith hangs ‘for sale’ sign over historic High Street stores

- Sage Group hits new high after 2024 results and buyback spur gains

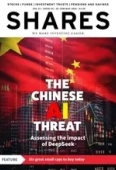

- US technology stocks tumble on surprise Chinese AI innovation

magazine

magazine