Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

US technology stocks tumble on surprise Chinese AI innovation

The fast-changing world of AI (artificial intelligence) has taken another unexpected turn after reports over the weekend that Chinese firm DeepSeek had developed a competitive LLM (Large Language Model) at a fraction of the cost of traditional AI models.

DeepSeek’s latest R1 model can perform similar levels of reasoning as OpenAi’s best available model, scoring as high or higher than ChatGPT-4 and Meta’s LLaMA 3.1 on a variety of third-party tests to measure performance.

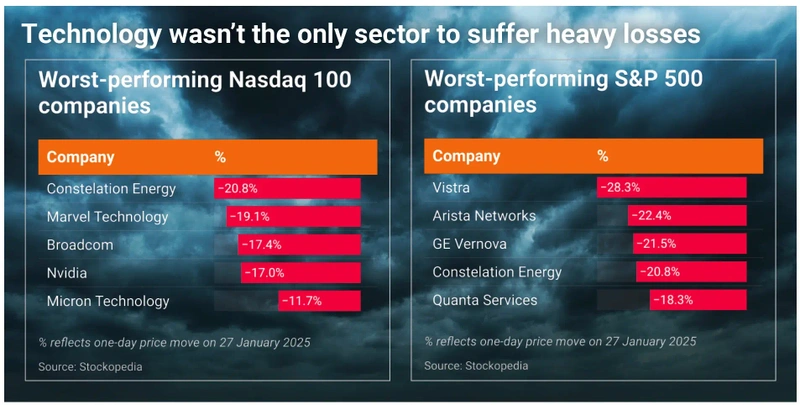

The news sent markets into a tailspin on 27 January, with the technology heavy Nasdaq 100 index tumbling 3%, wiping off over $1 trillion of market value and taking the benchmark S&P 500 index down 1.6% in its wake.

AI-darling Nvidia (NVDA:NASDAQ), whose high-end chips have powered the AI revolution, plummeted 17%, registering the biggest ever single-day loss for an individual stock of almost $600 billion.

Other casualties included US and European semiconductor chip names and energy and uranium stocks which have been bid up on the idea of massive demand from power-hungry AI chips.

It’s fair to say nobody knows exactly what the long-term implications of the latest innovation may be, but what has not been lost on investors is that that DeepSeek’s R1 requires far less energy and has been achieved using less advanced Nvidia chips.

The first model built by DeepSeek reportedly cost just $5 million, which is around a tenth or less of the cost of traditional AI models and requires far less power.

Perhaps the biggest challenge for the AI industry is that DeepSeek is open-source and therefore free for developers to download and use, allowing access to a much wider group of firms outside the so-called hyperscalers such as Alphabet (GOOG:NASDAQ) and Amazon.com (AMZN:NASDAQ).

The irony for the US administration is that policies designed to restrict Chinese access to the most advanced AI chips may have contributed to DeepSeek’s engineering success, demonstrating once more that necessity is the mother of all invention.

It also brings into question president Trump’s AI spending plans of up to $500 billion through the Stargate programme, which was only revealed a few days ago to great fanfare.

So, how worried should the big tech giants be? Mark Hawtin, global head of equities at Liontrust, believes DeepSeek is more than just hype.

‘In our view, the DeepSeek buzz is justified and more notable when considering the US imposed restrictions on Nvidia’s AI chips to stall AI advancement in China in an “arms race”,’ says Hawtin.

Instead of building one large AI which tries to encompass everything, DeepSeek’s engineers have designed a system of experts which are only called upon when needed, vastly reducing cost and power.

Effectively the design tweaks mean only 2,000 GPUs (graphics processing units) are needed instead of 100,000, and models can be run on gaming chips instead of data centre hardware.

Hawtin believes the open-source nature of DeepSeek’s R1 could ‘democratise’ AI and cause a tectonic power shift. ‘We could witness an explosion of new applications by decoupling AI advancement from high capital costs,’ explains Hawtin.

‘Open models enable customisation for niche-use cases that are often overlooked by Big Tech’s one-size-fits-all strategy, fostering creativity across all industries.’

In conclusion, Hawtin believes the Liontrust team’s positive view on AI is reinforced and there will be a broadening-out of the opportunity set. However, AI infrastructure players may become victims of the ‘right thesis at the wrong valuation’ mantra.

STRETCHED MARKETS

If the claims of DeepSeek can be substantiated, the narrative of US technology companies’ dominance is under threat exposing their valuations and the assumptions underlying them.

Investor enthusiasm for AI has created one of the most concentrated markets in history with the ‘Magnificent Seven’ representing more than a third of the S&P 500 index.

This concentration has contributed to double-digit gains over the last two years, pushing the valuation of the benchmark to levels not seen since the dotcom era.

Which is where the ‘Fed model’ − which compares the yield on 10-year US treasury bonds with the equivalent stock market yield, calculated as the inverse of the forward market PE (price-to-earnings) ratio − comes into play.

With the S&P 500 trading on a forward PE close to 25 times, that represents a yield of 4%, while 10-year treasuries yield 4.5%, even after they fell in response to market turmoil.

Stock market investors can typically expect to receive a 2% to 3% premium over the 10-year risk-free rate to compensate them for the extra risk involved in owning stocks − the so-called equity risk premium.

A negative yield gap or premium can therefore be interpreted as a sign of excessive risk-taking, and while there are those who criticise the model because it does not factor in inflation it is still closely-watched by the Fed as a gauge of market exuberance.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Dan Coatsworth

Feature

Great Ideas

Investment Trusts

My Portfolio

News

- Everyman Media plumbs the depths after registering all-time low

- Will Diageo shareholders be raising their glasses or downing their sorrows?

- Can Palantir keep the plates spinning as its valuation balloons?

- WH Smith hangs ‘for sale’ sign over historic High Street stores

- Sage Group hits new high after 2024 results and buyback spur gains

- US technology stocks tumble on surprise Chinese AI innovation

magazine

magazine