Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Find out how Phil started his investment journey with Cable & Wireless as a teenager in the 1980s

Keen investor Phil first got the bug in the mid-1980s when his mum bought him 100 shares in Cable & Wireless shares.

Cable & Wireless was a trailblazing cable company set up more than a century ago and by the start of 2000, C&W Group, as it was then, had a market value of around £38 billion. When the business was demerged in 2010 its value had shrunk to £4 billion – with the now two separate businesses acquired in 2012 and 2015.

For Phil, as he explains, the purchase of stock in Cable & Wireless ‘proved to be a beneficial transaction’.

He kept track of his investment by reading the Financial Times once a week. The way Phil monitors his investments today has changed. Nowadays he says he gets updates via the AJ Bell app and that’s not the only way his investing has changed over the years.

‘There have been many distractions [along the way] such as buying my first home, starting a family, and setting up a business,’ he says.

In 1998, aged 30, Phil set out his ambitions to retire between the age of 50-52 knowing that the mortgage would be paid off when he was 48. While this plan ultimately didn’t come to fruition Phil still has the goal of supplementing his income when he gives up work.

WORKING TOWARDS A COMFORTABLE RETIREMENT

‘My investment priority now is to avoid pension poverty and use my SIPP in a tactical way to generate enough funds over the next decade to supplement my state pension and provide a comfortable retirement,’ says Phil.

Phil has a certain figure in his mind for a comfortable retirement which is approximately £320,000. To fulfil his objective, he’s investing £86,000. Alongside his SIPP Phil has a trading account, but it is dormant due to lack of monthly disposable income. He hopes to reactivate his trading account when the ‘timing is right.’

Phil’s investment style is themed towards income and growth with a medium-risk appetite. He doesn’t have bundles of capital in reserve so to lose more than 20% of his SIPP ‘would be crippling.’

Phil uses data from free stock analysis and market research website Simply Wall Street, Shares and international and national news broadcasts.

He ignores the ‘hype’ of social media. Phil’s portfolio consists primarily of UK and overseas stocks because they ‘align with his purchasing criteria and long-term objectives’.

He holds international technology, and services company Rheinmetall (RHM:XETRA) which has had an ‘astounding couple of years’ and ‘keeps on issuing’ growth updates and agriculture machinery specialist Agco Corp (AGCO:NYSE).

WINNERS AND LOSERS IN PHIL’S PORTFOLIO

To keep on top of his investments, Phil monitors his portfolio daily noting any volatility, weekly increases and decreases in value. ‘I then periodically analyse this data for patterns, sequences to make informed decisions which align with my risk appetite and the compounding capability of my existing portfolio.’

Stocks that have done well include aerospace and defence company Rolls Royce (RR.). Stocks which haven’t done as well have been UK-based electric vehicle charging solutions firm PodPoint (PODP).

Phil bought 2,000 shares at IPO in November 2021, since then its shares have fallen more than 90%.

The other stock which has performed badly is Ukraine-based commodity trading and mining company Ferrexpo (FXPO).

The miners’ share price has fallen dramatically since the Russian invasion of Ukraine in February 2022.

WHERE PHIL DOESN’T INVEST

Phil doesn’t hold any bonds, investment trusts, and funds in his portfolio as he simply doesn’t fully understand them. He says about bonds and [asset class] property: ‘What little I have discovered [about bonds] is that they may be too volatile for my risk appetite.

‘[I have looked] at UK real estate investment trust Warehouse REIT (WHR) – which is a company focusing on UK commercial property warehouse assets - over the past 18 months, but a lack of understanding and minimal price movements has discouraged me from including in my portfolio.’

Although he does admit that he needs to carry out some research [to] expand his investment options.

One fund Phil does contribute to is the AJB Income & Growth Fund Acc (BH3W788). Phil uses this within his SIPP to ‘accumulate dividends’ and ‘store loose change’ from transactions.

DISCLAIMER: Please note, we do not provide financial advice in My Portfolio articles, and we are unable to comment on the suitability of the subject’s investments. Individuals who are unsure about the suitability of investments should consult a suitably qualified financial adviser. Past performance is not a guide to future performance and some investments need to be held for the long term. Tax treatment depends on your individual circumstances and rules may change. ISA and pension rules apply.

AJ Bell referenced in this article owns Shares magazine. The author (Sabuhi Gard) and editor (Tom Sieber) of this article own shares in AJ Bell.

WE WANT TO HEAR FROM YOU

We are looking for individuals or couples to share their experiences of managing their own investment portfolios.

If you would like to take part, we want to know why you chose certain stocks, funds or bonds, why you might have subsequently sold some of them, and what you hope to achieve from investing.

We will pay £50 in John Lewis vouchers as a thank you to anyone whose story is published in the digital magazine.

Drop us a line with your name and two lines describing your investment experience. For those picked to feature in the magazine, we’ll be in touch to get the full story.

CONTACT: shareseditorial@ajbell.co.uk with the words My Portfolio in the subject line.

DISCLAIMER: Shares/AJ Bell does not provide advice or personal recommendations. The My Portfolio articles are for information only. You must do own research and consider your own personal circumstances before making investment decisions.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Dan Coatsworth

Feature

Great Ideas

Investment Trusts

My Portfolio

News

- Everyman Media plumbs the depths after registering all-time low

- Will Diageo shareholders be raising their glasses or downing their sorrows?

- Can Palantir keep the plates spinning as its valuation balloons?

- WH Smith hangs ‘for sale’ sign over historic High Street stores

- Sage Group hits new high after 2024 results and buyback spur gains

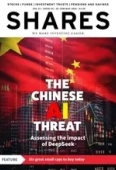

- US technology stocks tumble on surprise Chinese AI innovation

magazine

magazine