Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

WH Smith hangs ‘for sale’ sign over historic High Street stores

Shares in WH Smith (SMWH) jumped 5% to £12.11 on 27 January after the storied retailer confirmed it was ‘exploring potential strategic options’ for its High Street business, which opened its first shop in London back in 1792.

These options include a potential sale of all 500 High Street stores at a time when bricks-and-mortar retailing faces online competition, subdued footfall and a sharp rise in labour costs following the recent UK Budget.

A successful sale and repositioning of WH Smith as a pure-play travel retailer would no doubt be welcomed by investors – the High Street arm does make money and is cash-generative, but it has become less relevant to the group as a whole over the last decade.

With more than 1,200 stores across 32 countries, Travel is now the core business, selling an array of essentials ranging from food-on-the-go, drinks, health and beauty and tech accessories to books, newspapers & magazines.

The business is faster-growing and higher-margin than the High Street stores and now generates three-quarters of WH Smith’s group revenue and 85% of its trading profit.

After strong momentum during the peak summer period last year, the Travel division is well positioned to benefit from the structural growth in global passenger numbers. This was reflected in a positive update on 29 January.

WH Smith sees ‘considerable opportunities to win and open additional stores’, particularly in North America, the world’s largest travel retail market, where it has more than 300 stores so far and where chief executive Carl Cowling sees ‘excellent prospects to further grow our airport business’.

Regarding the High Street operations, Russ Mould, AJ Bell investment director, said: ‘There isn’t an obvious buyer, particularly if WH Smith is looking to sell everything together rather than in blocks of stores.

There aren’t many retailers who would want to take on an additional 500 stores in the current climate

‘There aren’t many retailers who would want to take on an additional 500 stores in the current climate. It’s probably a step too far for Frasers (FRAS), Next (NXT) is making the most of the stores it already has and B&M European Value (BME) seems to have enough on its plate to be so bold as to snap up the WH Smith portfolio.’

‘Interested buyers may want to repurpose the high street stores for alternative use. Turning shops into gyms has proved to be a successful model for many leisure operators and the fitness industry continues to grow in the UK.’

As Shares went to press, there were reports HMV – owned by Canadian businessman Doug Putnam – was interested in some or all of the stores.

Disclaimer: Financial services company AJ Bell referenced in this article owns Shares magazine. The author of this article (James Crux) and the editor (Ian Conway) own shares in AJ Bell.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Dan Coatsworth

Feature

Great Ideas

Investment Trusts

My Portfolio

News

- Everyman Media plumbs the depths after registering all-time low

- Will Diageo shareholders be raising their glasses or downing their sorrows?

- Can Palantir keep the plates spinning as its valuation balloons?

- WH Smith hangs ‘for sale’ sign over historic High Street stores

- Sage Group hits new high after 2024 results and buyback spur gains

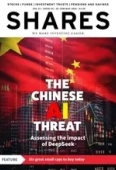

- US technology stocks tumble on surprise Chinese AI innovation

magazine

magazine