Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Saba loses first round as Herald shareholders vote down resolutions

On 22 January, as Shares was preparing to go to print, the board of Herald Investment Trust (HRI) announced all of the resolutions put forward by activist investor Saba Capital had been defeated.

The meeting was a first test of whether shareholders would stand by the boards of the trusts called out by US activist hedge fund Saba for underperforming. Votes against the resolutions totalled more than 26.4 million, equivalent to 65.1% of the votes cast, whereas Saba’s total reached 14.1 million or 34.75% of votes cast with a further 59,221 or 0.15% in favour of the resolutions.

Herald called the result ‘a damning indictment of Saba’s proposals’ and ‘a clear, complete and incontrovertible rebuttal of Saba’s attempt to take control of the company and change its strategy against the wishes and interests of its non-Saba shareholders’.

ENCOURAGING RESULT FOR OTHER TRUSTS

While there’s no room for complacency for the remaining trusts in the firing line, they will be encouraged by the result.

Herald chair Andrew Joy said: ‘We are well aware of the environment in which investment companies operate and the need to have regard for creating value not just by multi-year patient growth in NAV, which to remind people, has enabled a 27 times NAV total return since launch in 1994, but also by ensuring that capital allocation is optimised, again for the long term.

‘As evidence, Herald has bought back its own shares every year since 2007, including approximately 10% of the company’s share capital in each of the last two years. The company has only ever issued £95 million of stock and has bought back over £465 million already, and still has net assets of £1.2 billion.’

Richard Stone, chief executive of the AIC (Association of Investment Companies), called the result ‘a victory for shareholder democracy’ and urged investors in the remaining six investment trusts to vote at their upcoming meetings (see table) or risk losing their voice.

HOW TO VOTE

As a reminder. If you own your shares through a platform the voting process is straightforward.

On the AJ Bell website, for example, you can log into your account, click on the drop-down menu in the box titled ‘Account Menu’ and select ‘Voting Instructions’, which will bring up a new page listing your investment, a description of the event (in this case general meeting), the last date by which you need to send your instructions (usually a week or so before the event) and a button saying ‘Give Instruction’.

Clicking on this button takes you to the ProxyVote website, where you can view the meeting agenda, ‘learn before you vote’, or request to attend the meeting in person. Unfortunately by the time you read this the AJ Bell deadline will have passed for half of the planned meetings. Though it is still worth keeping tabs on the outcome of the meeting even if you’ve missed the chance to have a say.

Interestingly, US asset manager BlackRock (BLK:NYSE) reached a ‘standstill’ agreement with Saba meaning the activist will not take hostile action against four of its UK trusts for at least another two years.

The trusts involved are BlackRock American Income (BRAI), BlackRock Energy & Resources Income (BERI), BlackRock World Mining (BRWM) and BlackRock Smaller Companies (BRSC).

However, another five trusts on Saba’s ‘hit list’ have not announced an agreement – BlackRock Frontiers (BRFI), BlackRock Greater Europe (BRGE), BlackRock Income & Growth (BRIG), BlackRock Latin American (BRLA) and BlackRock Throgmorton (THRG).

The news follows the announcement of share tenders at two BlackRock US closed-end funds, the $1.8 billion BlackRock Innovation & Growth Term Trust and the $1.7 billion BlackRock Health Sciences Term Trust.

WHAT NEXT?

In total Saba has 24 disclosed positions in UK investment trusts, however if the Herald vote proves to be a decent guide to the outcome of the remaining requisitioned meetings, the chances of it pushing the same strategy elsewhere seem likely to be reduced.

DISCLAIMER: AJ Bell referenced in this article owns Shares magazine. The author (Ian Conway) and editor (Tom Sieber) of this article own shares in AJ Bell.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Dan Coatsworth

Feature

Great Ideas

Investment Trusts

My Portfolio

News

- Everyman Media plumbs the depths after registering all-time low

- Will Diageo shareholders be raising their glasses or downing their sorrows?

- Can Palantir keep the plates spinning as its valuation balloons?

- WH Smith hangs ‘for sale’ sign over historic High Street stores

- Sage Group hits new high after 2024 results and buyback spur gains

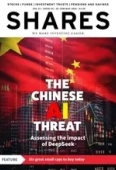

- US technology stocks tumble on surprise Chinese AI innovation

magazine

magazine